Foreign investment in stock markets halves

Foreign investment in the stock market of Bangladesh almost halved in the last five years owing to a lingering confidence crisis, the sharp fall in the value of the local currency, and the introduction of a floor price.

Foreign companies and individuals' investment dropped 20.8 percent year-on-year to $2.33 billion in the financial year of 2022-23. It was $4.5 billion in 2018-19, Bangladesh Bank data showed.

Of the sum, $1.12 billion was invested in debt securities.

"The portfolio investment slumped mainly due to a lack of governance, the depreciation of the taka, and the setting of the floor price," said Al-Amin, associate professor of the Department of Accounting and Information Systems at the University of Dhaka.

The decline came although the Bangladesh Securities and Exchange Commission (BSEC) held a number of road-shows to attract foreign investors to the stock markets of the country.

Prof Al-Amin said through the road-shows, the regulator portrays a positive image of the country in front of foreign investors. But when they look at the websites of the stock exchanges, they find that junk stocks rule the roost.

"Foreign investors realise that there is a lack of governance in the market. As a result, they don't feel interested in investing."

The floor price has also contributed to the denting of investor confidence.

In July 2022, the BSEC set the floor prices for every stock to halt the freefall of indices amid global economic uncertainties brought on by the coronavirus pandemic.

In December last year, the regulator lifted the measure for 169 companies in order to bring vibrancy to the market. However, the floor price was reintroduced for all stocks in March this year.

The floor price has turned the market dry since most stocks are not traded.

"Foreign investors don't like an illiquid market," Prof Al-Amin said.

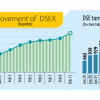

Owing to the lower participation of investors in trading activities, the daily average turnover of the Dhaka Stock Exchange plunged 40 percent to Tk 792 crore in the last fiscal year. It was Tk 1,328 crore the year prior.

The 30 percent drop in the taka's value against the US dollar in the past 18 months has dealt another blow to foreign investors.

"This is because the value of their assets has dropped even if the share prices have remained unchanged. So, foreign investors are selling shares," he added.

The taka depreciated by around 16 percent to Tk 108 in 2022-23, according to the central bank data.

The BSEC organised road-shows in 15 cities of eight countries from 2021 to 2023, in association with the Bangladesh Investment Development Authority.

"This is not the duty of the BSEC to hold road-shows. Rather, their duty is to ensure good governance in the market and eradicate manipulation," said a top official of a brokerage firm, preferring anonymity.

"However, the regulator has failed to regulate the market properly. As a result, manipulation is widespread."

The broker, who deals with foreign investors, also highlighted some of the long-standing issues that have remained unaddressed.

"The number of well-performing companies in the stock market of Bangladesh is small, so global investors don't want to invest here. Most of the investors don't trust the financial statements of the listed companies as well."

The broker said the government changes policies regarding listed companies frequently, which ultimately impacts the profitability of firms and thus investors.

For instance, the Bangladesh Telecommunication Regulatory Commission banned Grameenphone, the largest listed company in the country, from selling SIMs in June 2022 for failing to improve the quality of service. The restriction was withdrawn in January this year.

"Foreign investors will not pay heed to the regulator's plea and come to the market if problems are not dealt with properly," the broker said.

"If the government can solve the problems and ensure good governance, the regulator will not need to invite investors because they will come to invest in their own interest."

He said the central bank has kept the taka stronger against foreign currencies through artificial measures.

"The central bank should introduce a market-based exchange rate so that investors don't need to worry much about any currency swing."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments