Target forex reserve

The burgeoning forex reserve, now hovering around $40 billion, is turning a lot of heads, alarmingly though, as big borrowers shift their eyes from exhausted public banks to the secured coffers.

Orion Group is the first business conglomerate to make an official dig at the reserve for a $906.17 million (Tk 7,684.32 crore) loan to set up a coal-fired power plant, a development seen by experts as risky, uncertain and beyond the existing practice.

Though a loan has never been given to a private company from forex reserve for implementing a project, the state-owned Rupali Bank, through which the group made the move, and Bangladesh Bank primarily entertained the proposal.

"It's highly risky, and under no circumstances this should be allowed," Khondkar Ibrahim Khaled, a respected banker and former deputy governor of the central bank, told The Daily Star.

"Both the central bank and the government should consider the issue with the utmost importance."

Named Orion Power Unit-2 Dhaka Ltd, the coal-fired plant is to be set up on the bank of Meghna River (near Meghna Bridge in Gazaria upazila, Munshiganj) for generating 700 megawatt of electricity.

The conglomerate has proposed to shore up only 20 percent of the $1,138.43 million (Tk 9,653.88 crore, $1 =Tk 84.80) project from its own sources, hoping the remaining 80pc will come from the forex reserve, according to Rupali Bank documents prepared following the Orion Group proposal on July 26.

This newspaper has obtained a copy of the documents.

Prominent economist Professor Anu Muhammad thinks that the attempt to use the forex reserve for setting up a dirtyenergy plant should be treated as a criminal act.

"The forex reserve is considered as the national security of any country. The fund of the reserve is usually used when a nation faces fund crisis to settle international trade transactions," Anu Muhammad, also an ardent natural resources conservationist, pointed out.

Contacted, Md Ferdous Jaman, company secretary of Orion Group, said, "The cost of the central bank's loan will be lower than the funds offered by local and foreign banks for setting up the power plant."

Asked why the Group is not interested in taking foreign loans for the project, he said the interest rate of such loans is now low because of the ongoing economic slowdown but the rate may go up once the global economy rebounds.

Besides, a good amount of commission has to be paid against the guarantee of foreign loans, mentioned the company official.

"If fund cannot be managed from the forex reserve, we will take money under the existing syndication loan process," Ferdous added.

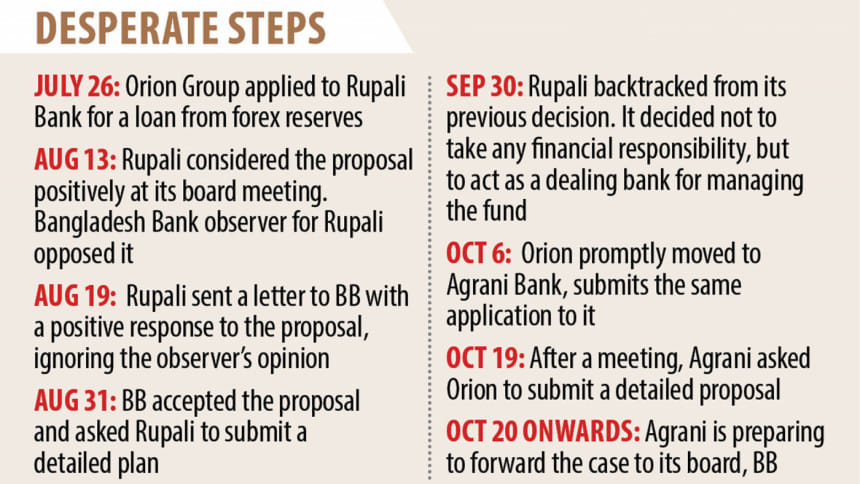

An uneasy situation arose ever since Orion applied for the loan from the forex reserve in July through Rupali Bank, with decision-makers at the state-owned bank and the central bank soon splitting into two groups -- one backing and the other opposing. But, it was all a very hush-hush affair amid strong lobbying.

Asian countries, except for a few, don't use their forex reserves for giving loans or making investments at home or abroad for a long term. Only a handful of rich Asian countries, including China, Singapore, Saudi Arabia and the UAE, have created sovereign wealth funds to manage their excess foreign exchange reserves by investing them in productive sectors.

AN UNCOMFORTABLE PROPOSAL ON MANY COUNTS

Orion has sought to be the first private entity for a loan from the forex reserve, but it would not be the last: a host of shady businesses are to follow suit. If sanctioned, it would go against the Bangladesh Bank Order 1972 for long-term lending. If Orion defaults on loan repayment, Rupali would plunge into an existential crisis with the financial responsibility for repayment.

If the rule for forex reserve is stretched, the government would have to act as guarantor of the unusual loan. It would be for a coal-fired plant project, from which the government is moving away. And then, Orion Group has a controversial past in using the funds of Orion Bank in 2007. (www.thedailystar.net/news-detail-16813).

Yet, on August 13, the Rupali board gave a go-ahead to its management to act as a "dealing" or "agent" bank of Orion, with full financial responsibility for the loan from the central bank reserve.

A string of scams, habitual loan defaults and irregularities over the years brought the banking sector to its knees, forcing the central bank to appoint its observers in 10 banks, six of which are public. Eight state-run banks accounted for 49.34 percent of the outstanding defaulted loans, amounting to Tk 96,116.65 crore as of June this year.

Acting as an observer for Rupali, Md Serajul Islam, an executive director of the central bank, strongly opposed the move. But his objection held no ground at the board meeting on August 13. It was brushed aside along with some directors' reluctance to take full responsibility for the loan, The Daily Star learnt talking to five bank officials directly involved in the matter.

Rupali went on to send a letter to the central bank six days later. Interestingly, the regulator of the banking sector saw no evil in the proposal. Rather, it responded positively to Rupali's proposal, asking, in a letter on August 31, for further details from the lender.

But then followed a dramatic turn of events. On September 30, the Rupali board came back to its senses at a board meeting and went back on its decision, concluding that it would take no financial responsibility for Orion loan.

Baffled, Orion rushed to Agrani Bank with the same credit application on October 6, requesting the state-run lender to manage its fund from the forex reserve.

Agrani had earlier struck a deal with Orion to be its lead arranger for a syndication loan, a financing in which a group of lenders work together to raise funds for a single borrower. Under the arrangement, Agrani has already approved Tk 120 crore loan to Orion, and Janata Bank Tk 574 crore and Premier Bank Limited Tk 200 crore.

But Orion is no longer interested in syndication loan, ever since it has set its eyes on the forex reserve. And, why should it be? A possible interest rate of 4 percent with a grace period of three years is no match for what is on offer from local banks at 9 percent. On top of it, the government is always there with a bail-out measure in case it defaults on repayment.

"..our foreign currency reserve is surplus, hence, with the guidance of our Honorable Prime Minister, govt has taken decision to invest foreign currency for mega projects like big power plants.. This will be supportive for saving foreign currency in the long run," read the application, undersigned by Orion Group Chairman Mohammad Obaidul Karim, to Agrani.

In recent months, the forex reserve has reached a new high on the back of remittance, dwindling import payments and budgetary support and loans from the Asian Development Bank, the International Monetary Fund, the World Bank, the Asian Infrastructure Investment Bank and the Islamic Development Bank.

Finance Minister AHM Mustafa Kamal told The Daily Star on October 7 that the government is exploring ways to invest in selected government projects with the forex reserve.

Top BB officials said that even if the government takes funds from the forex reserve, it will have to provide guarantee.

To win over Agrani, Orion argued in the letter that the lender will enjoy a hefty amount of commission by way of using the central bank's fund for implementing the project. A service charge of minimum 1.5-2 percent along with commissions and charges from opening of letters of credit of more than $800 would add to its gains. Besides, the project is to be mortgaged to the bank.

Orion's first meeting with Agrani on October 19 is learnt to have gone well, and the board will decide on it soon.

When approached, Mohammad Shams-Ul Islam, managing director of Agrani Bank, said that no decision has been made yet.

Steps will be taken after discussions with the bank's board, the central bank and the member banks of the syndication loan, he said.

"We will follow the related policy guidelines."

The total outstanding loans of Orion Group stood at Tk 6,036 crore in the banking sector as of November 2018, according to a report of the Credit Information Bureau of the central bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments