Dhaka bourse’s SME board falls prey to manipulators

Have you ever bought any pack of flour produced by Yusuf Flour Mills or heard the name of Yusuf Moyda, the brand under which the company is selling the item?

If the answer is no, then how could the stock of Yusuf Flour Mills be one of the most expensive on the Dhaka Stock Exchange (DSE)?

On February 28, its share price stood at Tk 2,312 on the SME board of the bourse, becoming the fourth costliest stock on the premier bourse of Bangladesh, leaving household names Berger Paints and Renata behind.

"The surge of the stock of Yusuf Flour Mills to the level of multinational companies shows what's actually going on in the stock market of Bangladesh," said Abu Ahmed, an analyst.

"What did the company pay back to its investors in the previous years that could have attracted a rational investor to buy it? Very little."

Since its listing, Yusuf Flour Mills has announced a cash dividend for its shareholders just once. It gave a 10 per cent cash dividend in 2020, DSE data showed.

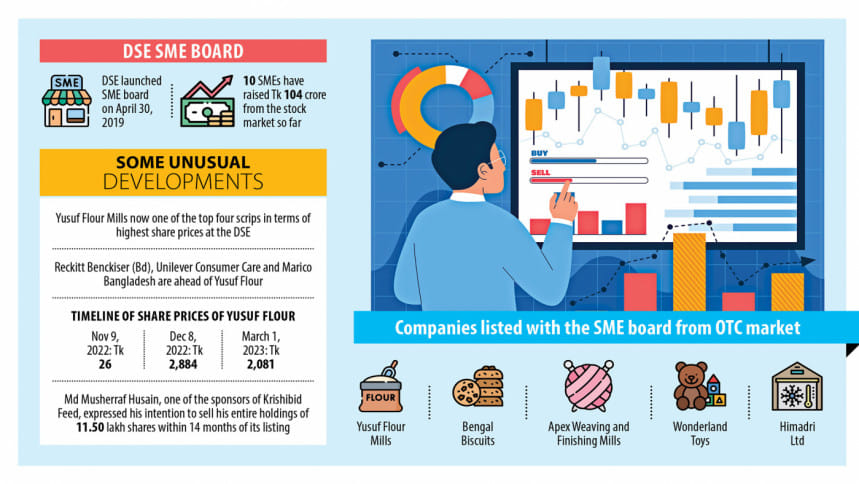

Yusuf Flour Mills was listed on the DSE in 1987. Because of the disappointing performance, it was sent to the over-the-counter (OTC) in 2009. In 2022, the company was brought back to the SME board.

The surprise did not end there.

A stock of Yusuf Flour Mills traded at Tk 26 on November 9 of 2022 only to skyrocket to Tk 2,884 in the span of just one month, a spike of 10,992 per cent, or more than 110 times.

"The rise of the stock price was mainly driven by manipulation," alleged Ahmed, a former professor of economics at the University of Dhaka.

Yusuf Flour Mills could not be reached for comments as its page on the DSE neither gave any contact number nor email address. The contact number on the company's own website was also found to be switched off.

Yusuf Flour Mills is not alone. In fact, most of the stocks that trade on the SME board have skyrocketed recently although the overall market has been in a bearish mood owing to the low confidence among investors because of the global and local crisis.

The stocks on the SME board surged in the past six months due mainly to speculation that a group of dishonest traders are now targeting the SME board to manipulate prices, according to analysts.

But when people start to invest in them, manipulators dump their holdings, forcing the stocks to plummet, they warn.

In August, the stocks of Krishibid Feed Ltd climbed to Tk 46 from Tk 15 in just three months. Then the stock started to decline and the downward trend accelerated after one of its sponsors announced to sell of his entire stake.

On February 2 this year, Md Musherraf Husain, the sponsor, expressed his intention to sell his entire holdings of 11.50 lakh shares at the prevailing market rate.

After the announcement, the stock slumped to Tk 15, down from Tk 25 before the price-sensitive information.

"When a sponsor sells his entire stake, it shows that the sponsor himself thinks that selling the shares is better than holding them," Ahmed said.

"It is clear that the hike in the company's share price has benefited the sponsors. The regulator should not let the sponsors sell their stakes within a short time after the company's debut."

Sponsors of the firms that trade on the main board of the DSE can't sell their shares within three years of listing. The lock-in period is just one year for SMEs.

The manipulation around the SME stocks would hand a huge blow to the small and medium enterprise segment in Bangladesh since investors' trust in the genuine SMEs would also be dented, depriving them of the cheapest source of capital in a country where small-sized firms find it difficult to raise funds.

The Bangladesh Securities and Exchange Commission (BSEC) launched the DSE-SME, the small-cap board, on April 30, 2019, so that SMEs having a paid-up capital between Tk 5 crore and Tk 30 crore could avail financing from the stock market.

"But manipulators have turned it into a gambling board," Ahmed said.

Ahmed urged the regulator to curb manipulation related to the SME board and communicate with SMEs to encourage them to raise funds from the market.

"Manipulators have targeted the stocks on the SME board as offloading the securities is easy. The BSEC has allowed general investors to invest in the board if they have handsome investments in the market," said a stockbroker.

In February of 2022, the BSEC eased conditions by reducing the minimum investment requirement to Tk 20 lakh from Tk 50 lakh. Investors don't have to take any permission now but it was mandatory previously.

After the relaxations of the rules, the SME Index soared 51 per cent, or 696 points in just one month, prompting analysts to criticise the BSEC move. Later, the minimum investment requirement was raised to Tk 30 lakh.

A huge number of investors still qualify to meet the condition, so they have been lured to the new board, the broker said.

"The board has offered a huge scope to manipulators to make unprecedented gains. But it is contributing little to help SMEs raise funds," the broker added.

The BSEC worked on Yusuf Flour Mills stocks and found that its price was overvalued mainly because the number of tradeable (free-float) shares is low whereas the number of sellers was a few, said Mohammad Rezaul Karim, spokesperson of the BSEC.

The number of shares of the flour mills is 6.06 lakh, of which 53.8 per cent is held by its sponsors, according to the DSE data.

Though the company reopened its factory, its earnings don't match the prices, he admitted.

"So, we are working to make the SMEs raise their paid-up capital. But it takes time," said Karim, urging investors to buy a stock after analysing companies' potential.

After the launching of the board, 10 SME companies raised Tk 104 crore from the market, DSE data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments