Our social safety net budget is neither equitable nor efficient

Social protection is an important component of the national budget in Bangladesh, which essentially aims to improve the welfare of vulnerable citizens. Identifying the pitfalls of the social protection system and realising the importance of improving it to meet certain objectives, Bangladesh adopted the National Social Security Strategy (NSSS) in 2015. Thereafter, it was agreed that the recommendations of the NSSS will be implemented through medium-term five-year plans and annual economic plans, such as the national budget. Based on this, the analysis for the social protection budget should ideally be carried out in line with the NSSS.

Reforms outlined in the NSSS fell under two broad categories: programmatic reform and institutional reform. On the other hand, the reforms may also be considered from equity and efficiency lenses. The proposal to cover 50-60 percent of vulnerable citizens, increase social protection expenditure to three percent of GDP, and enhance transfer values to reflect the needs of beneficiaries originate from an equity perspective. Improvement of the payment system (such as G2P), installation of an MIS system, establishment of a single registry, and digitisation of data are some of the proposals adopted in the NSSS on grounds of efficiency. Improvement of the beneficiary selection (that is, minimising the exclusion and inclusion errors) covers both equity and efficiency.

How does the social protection budget for the 2023-24 fiscal year fare when analysed through the lenses of equity and efficiency?

Allocation and equity

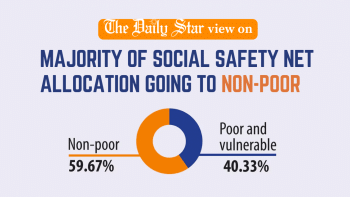

The government has allocated Tk 126,272 crore, around 7.4 percent more than last year's social protection allocation of Tk 113,576 crore. However, in terms of GDP, the allocation in FY2023-24 is 2.52 percent – which falls short of the NSSS target of three percent of GDP. This is a disturbing development. The Tk 126,272 crore allocation may be considered as gross allocation, since it includes a number of items which are not usually categorised as social safety net items. These include pensions for retired government employees and their families, interest payments for national savings certificates, agriculture subsidies, interest subsidy for SMEs, and allocation for health risk and natural shock management. Together, these constitute around 59 percent of the total social protection budget allocation for FY2023-24. In other words, the net social safety allocation for vulnerable citizens is only around 41 percent of the social protection budget. This amount was around 64 percent of the gross allocation in both FY2020-21 and FY2021-22. But a significant drop occurred in FY2022-23 by about 18 percent, and by 23 percent in FY2023-24. Again, the declining trend in net allocation is a serious cause of concern.

Another important observation is that, due to rural to urban migration, poverty and vulnerability have been shifting to urban areas in Bangladesh. However, the social protection system is not keeping pace with this development. As a result, the coverage gap (the difference between poverty rate and social safety expenditure) has widened for the urban poor in Bangladesh. The government must use the social protection allocation to reduce these gaps and establish parity in social safety budget allocation between rural and urban areas.

Beneficiary selection and efficiency

Bangladesh's social safety system is still beset with myriad exclusion and inclusion errors, reflecting the inefficiency in reaching out to deserving beneficiaries. To remedy this, the NSSS recommended establishing a single registry system (that is, a comprehensive database of existing and potential beneficiaries), a robust management information system (MIS), and a grievance filing mechanism. Progress has been slow on all these fronts. In particular, the country has neither established a single registry system, nor installed a robust MIS. The National Household Database (NHD) was initiated by the Bangladesh Bureau of Statistics (BBS) with support from the World Bank to prepare a comprehensive household-level database. However, NHD's fate is still unclear. Even if it is now made available, the database would have lost its relevance due to demographic transition (or dynamism) and large income growth. Meanwhile, the criteria used for beneficiary selection were prepared in 2013 and are still in use, raising serious concern about their usefulness due to their lack of dynamism and adaptability.

Since it is more or less accepted that the NHD has failed, it was expected that for the FY2023-24 social protection budget, the government would have rectified its position regarding the NHD by discarding it and experimenting with new alternatives that would be home-grown and less expensive. In this context, it should be mentioned that under the Asian Development Bank (ADB)-supported Covid-19 Active Response and Expenditure Support (CARES) programme, and in collaboration with the Department of Social Services (DSS), a pilot community-based targeting and selection process (CBTSP) was carried out in two unions in Bangladesh between March and April 2023. Only two programmes – old age allowance and widow allowance – were considered. In terms of selection efficiency, the pilot CBTSP produced encouraging outcomes suggesting that, with community involvement, it is possible to better identify beneficiaries for social protection programmes. And following focused group discussions, social mapping, transact walks, and dedicated household surveys, it would be possible to prepare a master beneficiary list and separate beneficiary lists for most of our social safety programmes.

Also, allowing private participation in social protection could improve efficiency, coverage, and lessen burden on the national budget. A modern and balanced social protection system is composed of three pillars: social assistance (SA), social insurance (SI), and active labour market programmes (ALMP). When SI and ALMP are active, private sector participation increases. However, both these pillars are underdeveloped in Bangladesh.

As is apparent, both equity and efficiency have been ignored while formulating the FY2023-24 social safety budget allocation. Unless measures are included to improve equity and efficiency, the benefits of the social protection budget will continue to be low. The government may consider some solutions in this regard.

First, it must commit to enhancing net social safety allocation to around three percent of GDP. The social protection budget should be used to ensure parity in allocation across rural and urban areas and across all age groups.

Since the NHD is not functional, the government must look for an alternative beneficiary selection approach. The CBTSP approach may be an important source of information to prepare an evidence-based social protection budget, which is likely to improve selection, reduce leakage, and improve value for money. However, in order to assess its robustness and scale it up at the national level, the CBTSP may be conducted in eight upazilas spread over four regions – north, south, east, and west – to allow assessments and inclusion of regional characteristics.

Additionally, the criteria used for beneficiary selection for social safety programmes need complete overhauling. Hence, there is a need not only to update them but also include periodic automatic updates in line with economic expansion. The government must also ensure balance between the three social protection pillars to generate maximum benefits and ensure private sector participation.

Dr Bazlul Haque Khondker is chairman at South Asian Network on Economic Modeling (Sanem) and former faculty member of the University of Dhaka. He can be reached at [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments