Don't mislead the public with inflated social safety funds

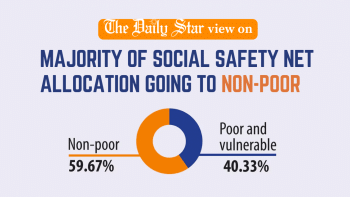

The inclusion of pension payments for retired public servants and their families as well as interest payments on savings certificates in the category of social security programmes makes no sense. Yet, the government continues to include these payments underneath its allocation for social security programmes, portraying an inflated expenditure figure on social safety net programmes (SSNPs). In the current fiscal year, such expenditures accounted for 30 percent of the total social security programme fund of Tk 126,090 crore, according to the finance ministry. Social safety net is for the protection of individuals who are vulnerable, but they are not benefitting from a large portion of the allocation as advertised.

In its analysis of the budget for the current fiscal year, the Centre for Policy Dialogue (CPD) classified the SSNPs into three categories—acceptable, quasi-acceptable, and non-acceptable. By analysing the allocation, it found that the SSNP budget continued to remain "artificially inflated," with seemingly unrelated allocations being reported in the SSNP list. The think tank further said that the share of compatible SSNPs in total social safety net schemes declined from 62.2 percent in FY2009-10 to 29.2 percent in FY2023-24. And its share as a percentage of GDP fell by more than half from 1.6 percent in FY2009-10 to 0.7 percent in FY2023-24. These are both significant reductions. What this indicates is that the government is spending a comparatively much lower share to protect the financially vulnerable, which is extremely concerning.

The immense economic struggle that the majority of people—particularly those in lower income groups—are currently facing is well-documented. They need more support, not less. But as experts have pointed out, if the items included in the list of social security are examined thoroughly, the allocation for social safety net will come down to only one percent of GDP. So, why is the government including other expenses in the SSNP list? Is it to intentionally paint a misleading picture?

The government needs to stop pretending like it is doing a lot for financially vulnerable people—because it is not—and take genuine steps to alleviate their sufferings. In that regard, it has to increase its budgetary allocation on actual social safety net programmes, and separate other expenses into another more appropriate category.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments