Financial account deficit keeps widening

Bangladesh's financial account deficit has kept widening as the flow of US dollars into the country is not picking up, in an indication that the pressure on the foreign exchange regime will persist in the upcoming days.

The financial account, a key component of a country's balance of payments, covers claims or liabilities to non-residents concerning financial assets and its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investment and reserve assets.

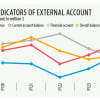

In July-August of the ongoing fiscal year of 2023-24, the deficit in the financial account stood at $2.01 billion, which was $247 million in the first two months of 2022-23, Bangladesh Bank data showed.

The financial account was $2.1 billion in deficit at the end of FY23, in contrast to a $15.5 billion surplus a year earlier.

Bankers say a lower short-term foreign borrowing by the private sector has been the main reason for the deficit.

In August, the short-term foreign debt in the private sector stood at $12.84 billion, down 3.82 percent from $13.35 billion in July, according to the central bank data.

In January, the figure stood at $15.58 billion.

The financial account deficit persisted in August largely because of a $2.36 billion shortage in the "other investment (net)" segment of the BoP.

The gross flow of FDI rose 3.14 percent to $985 million.

"Foreign lenders have lost their confidence in Bangladeshi companies as the country's forex reserves continue to fall," Zahid Hussain, a former lead economist at the World Bank's Dhaka office, told The Daily Star recently.

The gross foreign exchange reserve came down to $21.11 billion on September 26, owing to rising global commodity prices, supply disruptions, a slowdown in external demand, and a shift in remittance back to informal channels. It was $40.7 billion in August 2021.

The trade deficit, which takes place when imports surpass exports, narrowed to $1.01 billion in July-August, against $4.57 billion during the same period last year, on the back of higher shipments and lower purchases from international markets.

Exports were up 9.04 percent.

Imports dropped 22.30 percent, driven by the austerity measures put in place by the government to stop the depletion of the reserve and the putting on hold of investment and expansion plans by industries and businesses.

The current account balance returned to the positive territory at $1.10 billion from a negative $1.46 billion in July-August. The overall balance was $1.69 billion negative.

Md Deen Islam, an associate professor of economics at the University of Dhaka, said the widening deficit has both short-term and long-term repercussions for the economy.

"In the short term, it has led to a more pronounced depreciation of the taka and heightened inflationary pressures."

He thinks the deteriorating balance of payments and increased foreign exchange market volatility could potentially trigger capital flight, as foreign investors might lose confidence, leading them to withdraw their investments.

"This, in turn, could discourage new FDIs and other portfolio investments."

Islam said if Bangladesh continues to grapple with a persistent current account deficit alongside a financial account deficit, the country's import capacity will be curtailed.

"The combined effect of reduced foreign investment and lower imports may result in negative or sluggish growth in both employment and GDP."

"Bangladesh currently stands at a critical economic juncture, and the hard-won growth and prosperity achieved over the last decade could be in jeopardy if prudent macroeconomic policies are not promptly implemented."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments