Understanding the key points of the monetary policy

The Bangladesh Bank unveiled its monetary policy for the second half of the current fiscal year, with the goal to tame runaway inflation, which has been a concern for the past two years. Here are the major points of this monetary policy, and how they might -- at least in theory -- ensure a smooth economic journey for Bangladesh over the next six months.

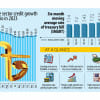

Policy rate raised to 8 percent

A central bank policy rate is the interest rate at which commercial banks can borrow money from the central bank. The intended effect of raising this rate is to reduce the supply of money in the economy by making it more costly to borrow. There has been a sustained effort by Bangladesh Bank to achieve this, with the policy rate being increased thrice since January last year from 6 percent to 7.75 percent. It is now being raised once more to 8 percent.

Private sector credit growth target reduced to 10 percent

Credit growth is the percentage change of total outstanding loans for a bank over the course of one year. Positive credit growth may be an indicator of growth in the economy, but it may also have negative connotations during times of inflation if credit growth is too high, meaning there is too much money being circulated in the economy. Reducing the private sector credit growth target from 11 percent to 10 percent is yet another measure designed to fight inflation, essentially telling banks in the private sector to limit their lending to a certain degree for the rest of the fiscal year.

The crawling peg to stabilise exchange rate

To curb the volatility of the taka and the risks posed by its rapid devaluation, this new exchange rate regime is being considered by the Bangladesh Bank. This is a balanced approach that uses the advantages of both a fixed exchange rate regime, and a floating exchange rate regime. This is done by formulating a band (or a range) of exchange rates using a carefully curated basket of currencies. The pegged currency, in this case the Bangladeshi taka, is then allowed to fluctuate within this band as necessitated by volatile economic conditions such as high inflation.

The reason a crawling peg might be the right tool for the current economic situation in Bangladesh is because it would provide stability for the BDT, which will encourage foreign trading partners.

GDP growth target reduced to 6.5 percent, inflation target raised to 7.5 percent

This revision by the Bangladesh Bank can be seen as an admission of the challenges faced by the economy during this fiscal year. The GDP growth target has been reduced from 7.5 percent to 6 percent following reduced projections by the IMF (from 6.5 to 6 percent) and the World Bank (from 6.2 percent to 5.6 percent).

By raising the inflation target to 7.5 percent from 6 percent, the central bank has addressed the rising cost of imports as well as goods, owing to a range of challenges faced by the economy. However, the risk of exceeding this inflation target remains as the World Bank and the IMF both project higher inflation rates for Bangladesh in the current fiscal year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments