Bangladesh’s rise in mobile money: A global perspective

The mobile financial services (MFS) are growing faster in Bangladesh than its global low- and middle-income counterparts, driven by people's widespread adoption of handset-based solutions in the absence of their active participation in traditional banking channels.

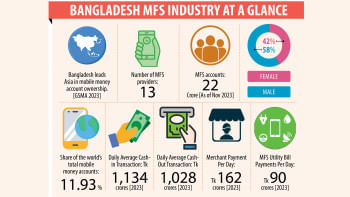

The country's registered mobile money accounts grew year-on-year by 16 percent to 21.77 crore in October 2023 from 18.75 crore in the previous year, as per the latest data from the Bangladesh Bank.

According to GSMA, a non-profit organisation that represents the mobile network operators worldwide, the number of mobile money accounts increased by 13 percent to 160 crore across the world in 2022 from a year ago.

In the same period, the number of mobile money users in Bangladesh rose by 12.56 percent to 19.10 crore.

In a comparative analysis, Bangladesh has demonstrated a growth rate closely aligned with the global average, holding an impressive 11.93 percent share of the world's total mobile money accounts in just a decade-long journey since 2011.

Meanwhile, the global daily transaction via mobile money exceeded $2 billion in 2020, surpassing $3.45 billion (equivalent to Tk 37,878 crore) in 2022. Whereas, mobile account holders in Bangladesh transacted average Tk 2,989 crore daily that year, which was 7.8 percent of the global daily average.

As per the central bank's latest data (until October 2023), the average daily transaction was Tk 3,646 core last year.

The recent surge in the MFS sector signals a transformation in Bangladesh's financial landscape, echoing global trends. Yet, in Bangladesh, with a population exceeding 170 million, the gender gap in this sector surpasses that of other countries.

According to the GSMA's report titled "State of the Industry Report on Mobile Money 2023", Bangladesh leads among Asian countries in mobile money account ownership, with 45 percent male and 20 percent female representation in the total population.

Indonesia claims the second-highest mobile money account ownership (18 percent male, 15 percent female) in the region, with Pakistan ranking third (26 percent male, 4 percent female), and India securing the fourth position (16 percent male, 4 percent female), as reported by the GSMA.

Moreover, Bangladesh secured the fourth position among the top nine MFS-growing nations in the world. Other nations are mostly in Africa -- such as Kenya, Ghana, Nigeria, Senegal, and Ethiopia.

Kenya emerged as the leader with 94 percent male and 92 percent female mobile money account ownership, followed by Ghana with 88 percent male and 79 percent female accounts.

Despite the general expansion in mobile money account ownership, a notable gender gap persists across low- and middle-income countries (LMICs). GSMA's analysis of the World Bank's Global Findex 2021 reveals that women in LMICs are 28 percent less likely than men to possess a mobile money account.

Recent data from the GSMA Consumer Survey reveals Kenya has the lowest, only 2 percent, gender gap in mobile money account ownership.

Bangladesh has the third-highest gender gap of 55 percent in mobile money account ownership in 2022, followed by Pakistan and India having 85 percent and 75 percent gap respectively, owing to a range of factors, including social norms and low mobile ownership among women, according to the GSMA report.

Men's account ownership increased from 41 percent to 45 percent in 2022 while women's account ownership has stayed the same at 20 percent widening the gender gap in Bangladesh.

Similarly, in Pakistan, men's account ownership grew from 19 percent to 26 percent in the past year while women's ownership remained unchanged at 4 percent.

Men, and especially women, who live in rural areas tend to experience the barriers to mobile money account ownership more acutely than their urban counterparts, including lower awareness, lack of a mobile phone, lower digital skills and more restrictive social norms.

Measuring financial inclusion in term of how often one uses mobile money and for what purpose, Bangladesh ranks second in Asia and fifth among global counterparts with 89 percent of males and 77 percent of females using mobile accounts for sending money, saving, or food payments as a part of 30-day basis activities.

In these criteria, India topped in Asia and secured fourth in the world with 81 percent of males and 86 percent of females using their accounts. Such activities were highest in Kenya where 94 percent and 91 percent males and females use their accounts respectively.

However, the 30-day activity rate among female mobile money account owners was 13 percent lower than men in Bangladesh. This gap is highest among all the peer countries, according to the GSMA report.

To this end, India's scenario is completely different as women used mobile money accounts 6 percent higher than male, which is the highest female activity among all the surveyed nations.

Despite the notable growth, the MFS sector has been experiencing some barriers across the globe. The most important barrier is preventing the account holders from owning an account that they do not perceive mobile money as being relevant to their lives.

The second greatest barrier is a lack of knowledge and skills, such as not knowing how to use mobile money, difficulties using a handset or low literacy, according to the GSMA.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments