Financial account deficit narrows slightly

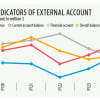

The deficit in the financial account narrowed slightly in July-December of the current financial year, highlighting an easing of stress facing Bangladesh, central bank figures showed yesterday.

The shortfall, almost a rare in the country's history, stood at $5.39 billion in the first half of 2023-34, showing an improvement from $5.48 billion registered in the first five months of the year.

The financial account, a key component of the balance of payments (BoP), records transactions that involve financial assets and liabilities and that take place between residents and non-residents.

It covers claims or liabilities related to foreign direct investment (FDI), medium and long-term loans, trade credits, net aid flows, portfolio investments, and reserve assets.

The current situation was a stark reversal from the identical period of the last financial year when the financial account was in surplus at $144 million. The apparently sound health could not be maintained at the end of 2022-23 as foreign currency outflows outpaced inflows.

Consequently, in FY23, the financial account was $2.1 billion in deficit, in contrast to a $15.5 billion surplus a year earlier.

The unprecedented blow led to a continued decline in the foreign currency reserves, bringing in one of the worst economic crises for Bangladesh as inflation surged to a record high.

Historically the financial account has experienced a surplus almost every year. In FY23, it experienced a sharp reversal owing to faster than anticipated global monetary tightening, lower than estimated project finance disbursements, significant delays in repatriation of export proceeds, decline in trade credit and private external credit inflows and higher repayments than new loans owing to a spike in global financing costs, according to the International Monetary Fund.

The narrowing of the deficit in July-December of FY24 was driven by an improvement in the gross inflows of FDI and investment by non-resident Bangladeshis (NRBs), among other factors.

For example, FDI stood at $1.83 billion in the first half of the fiscal year, up from $1.52 billion a month ago but down from $2.52 billion during the same period in FY23.

NRB investment improved to $55 million from $48 million. It was $56 million in July-December of FY23, BB data showed.

Net portfolio investment, also a part of the financial account, was a negative $80 million in the first half of FY24, against $38 million negative in July-November and $25 million in the first half of FY23.

Net aid flows rose to $2.93 billion from $2.78 billion.

Medium and long-term loans were up 8.68 percent at $3.88 billion. Amortisation payments against such loans increased 20.08 percent to $951 million.

Net long term loans in other areas surged to $407 million from $18 million.

Between July and December, net short-term loans were $1.32 billion in negative, highlighting a rise in repayments against credits although it was a surplus at $219 million during the identical period of FY23. It was $1.05 billion in negative in the first five months of FY24.

BB data showed gross official reserves, as per the definition of the IMF, stood at $21.87 billion in July-December, against $26.02 billion in the identical half of FY23. The reserves could cover import payments for 4.8 months.

The deficit in the BoP declined to $3.67 billion from $6.45 billion a year ago.

Exports rose 0.64 percent year-on-year to $25.99 billion.

Imports slipped 19.80 percent to $30.58 billion owing to the BB curbs aimed at limiting non-essential purchases from the international markets, and the lingering forex crisis.

The current account balance, which shows a country's key activity, such as capital markets and services, was $1.93 billion, which was $465 million a month ago and a deficit of $4.92 billion in the first half of FY23.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments