IMF Loan: Govt may miss two key targets set for fourth tranche

The government is likely to ask the International Monetary Fund (IMF) to revise down two key targets related to Net International Reserves (NIR) and tax revenue collection, set for June this year for the release of the fourth tranche of its $4.7 billion loan, finance ministry officials said.

An eight-member IMF mission, led by Chris Papageorgiou, has been in Dhaka since April 24 for the second review of the loan programme before releasing the third tranche worth $681 million, expected in June.

The mission held a series of meetings with key government bodies, including the finance ministry, Bangladesh Bank and National Board of Revenue (NBR) over the last few days, and is now assessing Bangladesh's progress related to the conditions set for the third tranche.

The meetings also discussed the key conditions for the fourth and fifth tranches, officials said.

The fourth tranche is expected in December this year.

Yesterday, the IMF mission held a meeting with government officials and came up with a mid-term review on the outcome of the meetings held in the past few days.

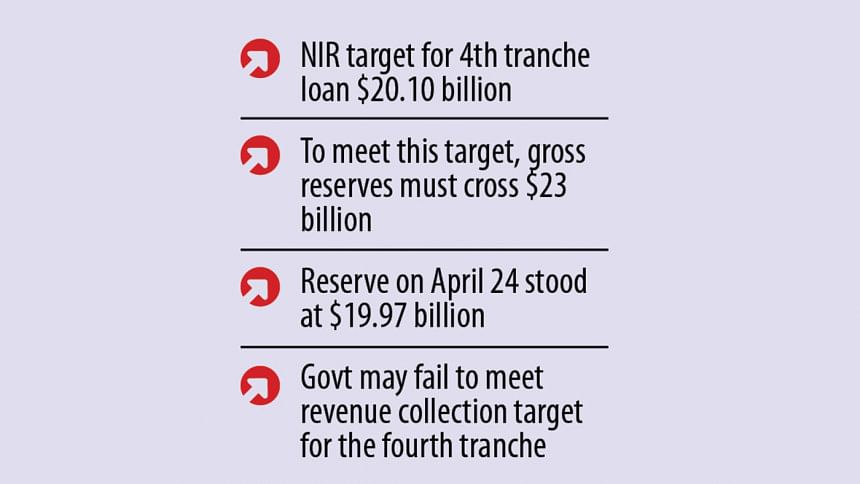

Already, finance ministry and Bangladesh Bank officials communicated with the IMF mission that the government may fail to meet the NIR and revenue collection targets set for the fourth tranche on time.

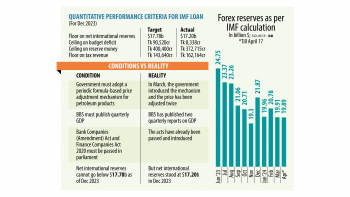

For the third tranche, Bangladesh has met all but one conditions related to NIR set for December last year. The revised NIR target was $17.78 billion in December, but the country fell short by $58 million.

For the fourth tranche, the IMF set the NIR target for June this year at $20.1 billion.

As its loan condition, IMF considers NIR by deducting about $3 billion from the gross reserves. So, if Bangladesh is to meet the $20.1 billion NIR condition, its gross reserves have to cross $23 billion in June.

However, the reserve situation has not improved much since the commencement of the loan programme January last year. The country's gross forex reserves have been around $20 billion in recent months, as per an IMF calculation. It was $19.97 billion on April 24.

The government had expected the reserve to improve after the January 7 election, but it did not.

The central bank blames it on the huge deficit of financial account of balance of payment, which crossed $8 billion in the first eight months of the current fiscal year.

According to the IMF assessment, the reason behind the deficit in the financial account is that the exchange rate is not market-based. As a result, export proceeds are not coming to the country while remittances are coming through unofficial channels.

A finance ministry official said even if IMF revised down the NIR condition, it could put various conditions to make the exchange rate market-oriented.

Meanwhile, although Bangladesh has met the floor tax revenue collection target for the third tranche, it may fail to meet the target of collecting Tk 3,94,530 crore by June set for the fourth tranche, finance ministry sources said.

To meet the June target, 20.39 percent growth in tax revenue collection is required. However, in the first seven months of the current fiscal year, tax revenue collection growth was 12 percent.

As per the finance ministry estimate, highest Tk 3,80,000 crore could be collected by the end of June.

For the $4.7 billion loan, the IMF has set two types of conditions -- six performance conditions and several structural conditions.

For the next tranches, the government has been discussing structural conditions with IMF.

A finance ministry official said IMF may set a condition for the government to reduce its spending on subsidy.

The government has already introduced an automated pricing formula for fuel as it no longer subsidises the sector.

However, as the government still provides subsidy for electricity and gas, the IMF may set conditions to follow a timeline for gradually reducing subsidy for these two items.

Already, IMF has collected data on government spending in subsidy for electricity and gas.

The global lender has also put several conditions for NBR to increase revenue collection.

Under one condition, NBR has to finalise its medium- and long-term revenue strategies covering indirect and direct taxes and accompanying implementation framework by September this year.

Another condition is requirement of e-return filing and online payment for tax years starting after June 30, 2024, for all large corporations and any corporation that claims any tax performance (such as an exemption, lower tax rate, or tax holiday) by the end of June 2025.

Also, IMF may put a condition to reduce default loan including setting a ceiling on the percentage of classified loan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments