Linde, Renata surge, sending Dhaka stocks to two-month high

Stocks in Bangladesh climbed 1.6 percent yesterday, driven by a surge in the prices of some blue-chip companies such as Renata PLC and Linde Bangladesh.

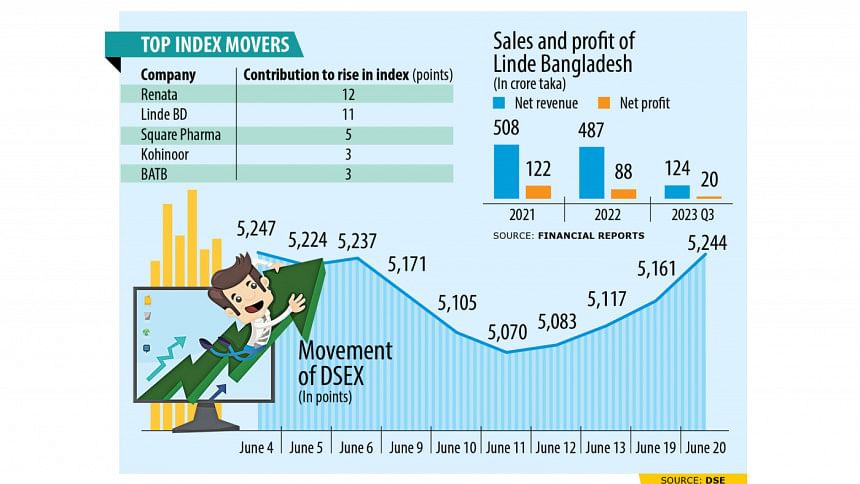

The DSEX, the broad index of the Dhaka Stock Exchange, jumped 82.75 points to close the day at 5,244. With this, the key index rose for the fourth consecutive trading session.

The 1.6-percent spike is the highest single-day increase since April 28.

Linde and Renata shares were high in demand on the largest stock market of Bangladesh after their corporate disclosures drove prices higher, thus contributing to the hike in the benchmark index.

Linde rocketed 43 percent to Tk 1,409 after its board declared a 1,540 percent interim dividend for January-October of 2023.

Renata rose 7.49 percent days after its disclosure of the first shipment of drugs to the highly regulated market in the United Kingdom.

Both companies together contributed 24 points to the DSEX, according to LankaBangla Securities. Square Pharmaceuticals, Kohinoor Chemicals, and British American Tobacco Bangladesh collectively added 11 points.

"Linde had a major impact on the market as it has drawn investor attention to the blue-chip stocks and multinational companies," said Emran Hasan, managing director at Investit Asset Management Limited.

"It was a catalyst."

In the Bangladesh market, he explained, trade is driven by a cluster or sector. Therefore, MNCs and blue-chip stocks fared well on the back of Linde's record dividend.

In recent months, multinational companies and sound stocks suffered owing to the lingering macroeconomic challenges and the US dollar crisis. As a result, they have become cheap.

The DS30, the index that represents the blue-chip firms, advanced 1.7 percent to 1,875. Similarly, the DSES, the index that comprises Shariah-compliant companies, climbed 2.21 percent to 1,146.

A top official of a brokerage firm said most general investors were in a buying mood yesterday as the market started to rise after a massive fall in recent weeks.

Turnover, which indicates the volume of shares traded during the session, stood at Tk 452 crore, up 83.79 percent from a session earlier.

Of the issues that traded on the Dhaka bourse, 288 advanced, 55 closed lower, and 50 did not see any price swing.

Linde Bangladesh announced the higher dividend although its profit took a beating from a fall in sales, an elevated level of raw material prices, and a sharp depreciation of the taka.

The manufacturer of various types of industrial gas said its board had approved an interim dividend of Tk 154 per ordinary share for January-October. It comes shortly after the sell-off declaration of the welding business.

"In our view, this is a possible one-off dividend, distributing the sell-off proceeds by the company," said BRAC EPL Stock Brokerage Company in a note to clients.

Speaking to The Daily Star yesterday, Abu Mohammad Nisar, company secretary of Linde Bangladesh, said the company is yet to complete the audit for the full year, so it has announced the interim dividend.

If the interim dividend remains unchanged or goes up further when the company's financial year ends on December 31, it will be the highest payout for the shareholders in at least nine years, data from the DSE showed.

Profits slumped 66 percent year-on-year to Tk 26.25 crore in January-October. It stood at Tk 77.60 crore in the same period a year ago. Therefore, the earnings per share declined to Tk 17.25 from Tk 50.99.

"The EPS decreased due to the demerger of welding business, lower sales, and higher price of raw materials in the international market coupled with the recent forex movement," Linde Bangladesh said in a filing on the DSE yesterday.

The taka has lost its value by about 35 percent against the US dollar in the past two years, which has made imports costlier.

The net operating cash flow per share of Linde rose to Tk 29.50 from Tk 28.77 while the net asset value per share slipped to Tk 372.92 on October 31 last year from Tk 397.44 on December 31 in 2022.

Linde has been a key player in Bangladesh's industrial gas sector for more than 50 years. Operating through 18 sales centres, it serves more than 35,000 customers.

Its products include liquid and gaseous oxygen and nitrogen, argon, acetylene, carbon dioxide, dry ice, refrigerant gases, lamp gas, and medical oxygen.

Linde has decided to divest its welding electrode business to ESAB Group, an American-Swedish industrial company, by selling 13.82 crore shares of Linde Industries Private Ltd, a wholly-owned subsidiary of Linde Bangladesh.

Electrodes are the biggest contributor to Linde's revenue and its longstanding business, with 53.3 percent of its income originating from the segment in 2021-22.

It made a profit of Tk 122.58 crore in 2021 and Tk 88.33 crore in 2022, BRAC EPL's note added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments