Matiur’s stock scandal just the tip of the iceberg

Md Matiur Rahman, the disgraced senior official of the National Board of Revenue (NBR), opened a Pandora's Box when he claimed during an interview with a local television station that he received placement shares of a company below the face value.

Placement refers to the sale of securities to a group of investors, either on a public or private level.

Companies can't sell their shares at a discount without getting any special approval from the High Court. Therefore, how did the influential tax man get the share of Fortune Shoes at Tk 8 instead of the face value of Tk 10 before it went public in 2016 raised questions.

Analysts have long alleged that most of companies are compelled to give shares to the influentials sometimes at a price that is lower than the face value and sometimes free. And without issuing shares to powerful people, companies will face difficulties in getting listed and running their business, they said.

Furthermore, some companies gift placement shares to the vested quarters to avail illegal benefits from authorities and regulators.

However, these transactions are not reported in the financial reports of companies though auditors or regulators can detect them by checking the track records of the fund transfers needed to purchase the placement shares.

Anyone can buy placement shares. However, companies usually sell them to friends and family members. Such shareholders need to hold the securities for one year or more before getting the chance to sell them in the secondary market after the listing and earn a profit.

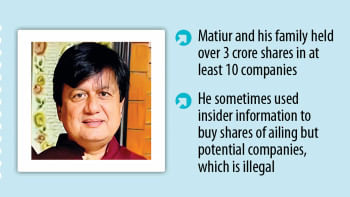

Matiur Rahman received more than three crore placement shares from 10 listed companies. During the interview with NTV, he admitted that he got shares from one company at lower than the face value. This gave an idea of what could happen in the case of other companies.

Rahman is not the lone person who received placement shares in such a manner.

The Bangladesh Securities and Exchange Commission (BSEC) detected that many received shares of Ring Shine Textiles who had no proper documents of paying the due amount. The names of many influential people were also disclosed in 2021.

There are also instances when some companies issued shares to people at higher prices before discarding their plan to go public. As a result, general people lost their funds. However, the regulator has not asked the companies to repay the funds to the affected investors.

Since the BSEC has failed to curb irregularities related to private placement, many influential people are still taking advantage of lax law enforcement, said several analysts.

Matiur Rahman acknowledged his wrongdoing on June 19, but the BSEC has yet to take any action against him or the company. On Sunday, he was removed from the NBR and attached to the finance ministry.

But the BSEC should have opened an investigation into Rahman's case to find out how deep the irregularities were and how he manipulated the system and abused the power. But the BSEC has remained silent.

It is normal for a company to issue shares to raise funds before it is going to be listed. However, the process of share allocation should be transparent so that none can receive stocks at a discounted rate or without paying any money.

A thorough investigation is necessary to find out how the system has been gamed and how it can be mended. The influentials must be brought to book to restore investors' confidence in the stock market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments