NBR must answer for repeated failure

The National Board of Revenue (NBR) has, quite predictably, failed to meet its revenue target for the 12th consecutive year, prompting experts to call for the existing tax collection framework to be overhauled. In the fiscal year 2023-24, the tax authorities collected overall receipts of Tk 382,562 crore—falling short of its revised target by Tk 27,438 crore. The government had initially aimed to collect taxes of Tk 430,000 crore in FY24 but ultimately brought down the target by Tk 20,000 crore.

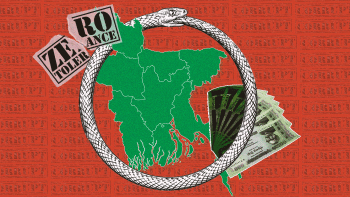

As per provisional data, despite failing to reach the revised target, the NBR registered a 15 percent growth in collections in FY24 compared to a growth of 10 percent in FY23. Although this last part can be interpreted as the tax authorities making some progress, experts suggest that the entire tax administration remains in desperate need of reforms. The tax to GDP ratio in Bangladesh is among the lowest in the world, reaching an estimated 7.38 percent in FY23. The ratio has been limping along for years despite repeated calls for it to be increased. There have been plenty of instances of late where low revenue collection has hamstrung government responses in the face of emerging economic difficulties. Any desired progress in this regard has been stifled by corruption and inefficiencies in the tax administration. Recent revelations about Matiur Rahman, former president of the NBR's Customs, Excise and VAT Appellate Tribunal, who came under the scanner for allegedly amassing crores of taka via corruption, is a case in point.

This trend cannot be reversed without good governance and accountability. If the government really wants to enhance its revenue collection capacity, it should also ensure full automation of the NBR's services. Additionally, tax evasion—particularly by vested interest groups closely connected with the ruling establishment—must be stopped, while misguided attempts such as trying to boost revenue by allowing "whitening" black money should be abandoned.

The government has to address the lack of efficiency in the tax administration to increase its flexibility to intervene during critical times such as now. Otherwise, the country will continue to face crippling economic problems and limitations going forward. At the same time, it has to do a better job of setting realistic tax collection goals, and plan its expenses accordingly. As experts have pointed out, over the past 10 to 15 years, the government has been setting overambitious revenue collection targets that are completely detached from the ground realities. Repeated failure to meet the revenue collection target has spoiled the credibility of our fiscal framework, which the government needs to earn back through proper policy response.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments