Hollow promises leave investors holding the bag

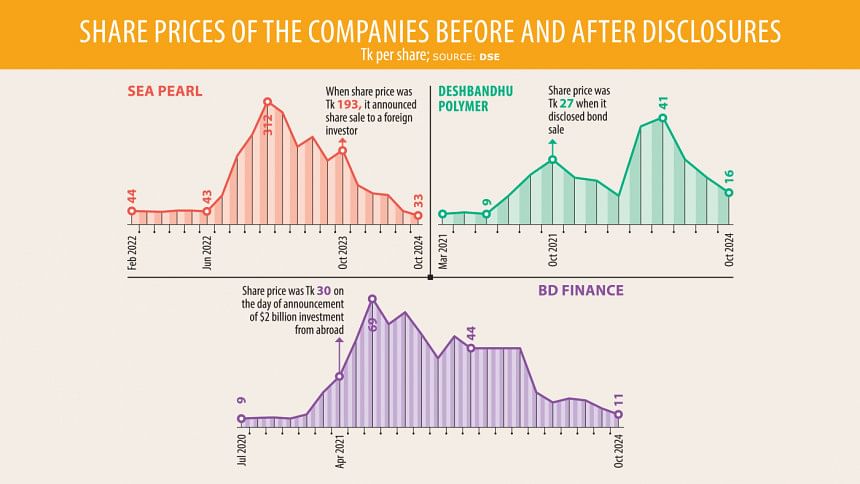

The share prices of Sea Pearl Beach Resort and Spa Limited soared from Tk 60 to Tk 320 on the Dhaka Stock Exchange (DSE) within just one year after frenzied speculation in 2023 that a foreign investor would buy a significant stake in the company.

Peculiarly, the sudden speculation proved to be prophetic.

In late October of 2023, the stock market regulator announced in a price-sensitive disclosure that it had given approval to GEM Global Yield to buy around 10 percent of the company's shares within a year.

"Share price of a company is positively influenced when the firm announces that a foreign company will buy its shares. So, the regulator should monitor the progress of price sensitive information disclosed by companies and see if there is any ill-motive.

Interestingly, after the price-sensitive information (PSI) was revealed, the company's share price fell drastically.

It has become a common scenario in the last few years to see the prices of stocks soar manifold based on speculation. It is also commonplace that when such conjecture is confirmed through the disclosure of PSI, stock prices begin to tumble.

According to Saiful Islam, president of the DSE Brokers Association, if a stock price triples before PSI is brought to light, it indicates the existence of insider trading.

"Definitely, whoever is trading such shares knows some PSI and is spreading it to people to raise share prices," he said.

He added that investors suffer the most if plans revealed in such disclosures are not implemented, which is exactly what happened in the case of Sea Pearl.

One year has passed since the disclosure, but the sale of shares to the foreign investor has not yet been executed.

In the meantime, Sea Pearl's share price has plummeted to Tk 33.

In such cases, if investors purchase stocks after seeing price-sensitive disclosures with the assumption prices may rise, they face huge losses.

The case of Sea Pearl is not the only example of unfulfilled promises in a price-sensitive disclosure. Similar incidents abound. Take the case of Deshbandhu Polymer Limited.

The manufacturer of polypropylene woven bags announced in 2021 that it planned to raise Tk 500 crore by issuing a Sukuk bond abroad to repay loans and fund business expansion.

Before the announcement, the share price of the company soared 178 percent within six months to Tk 27.

Afterwards, the company never bothered to provide any further disclosures on the topic.

At present, its share price has dropped to Tk 16.

Moreover, the DSE and the Bangladesh Securities and Exchange Commission (BSEC) have done nothing about such companies' failure to implement what they had outlined in disclosures.

Neither have the companies done anything to shed light on the status of those plans.

Another company that employed similar tricks is Central Pharmaceuticals Limited.

The drug company announced in February of 2017 that a local group would buy its sponsors' shares, leading the stock price to nearly triple from Tk 13.6 to Tk 36.1 within four months.

However, the stock price dropped massively after the company later announced that the deal would not be signed.

This sudden U-turn caused huge losses to general investors, but nobody has been held accountable.

At present, the company's shares are traded at Tk 8.50 each.

"Information provided in price-sensitive disclosures may not be implemented for business reasons. But, when it happens time and again, it indicates that the PSI was fabricated as part of a scam," added DSE Brokers Association President Islam, also a director at Brac EPL Stock Brokerage.

He emphasised the need for the DSE and BSEC to strengthen the monitoring of price-sensitive disclosures and their implementation, adding that it was nothing more than a simple monitoring issue.

Faruq Ahmad Siddiqi, a former chairman of the BSEC, said a company's share price is usually influenced positively after it discloses that a foreign company will buy its shares.

"Sometimes, listed companies provide such disclosures intentionally to influence share prices. But a primary deal may fall through for business reasons as well," he said.

He suggested the BSEC scrutinise whether the disclosed plans are being implemented and investigate any ill-motivated decisions.

The BSEC has a responsibility to get to the bottom of such matters and inform investors, Siddiqi added.

Sharif Anwar Hossain, a former president of the DSE Brokers Association, said directors sometimes provide disclosures to raise share prices.

Such directors then sell their stakes and buy back the shares in someone else's name, he added.

Hossain suggested the BSEC rethink disclosure-related rules and consider only allowing companies to make such disclosures when a deal is close to happening, especially as investors are heavily impacted.

The stock market regulator should strongly punish directors if it finds they provided disclosure to only raise share prices, he added.

"Without exemplary punishments, such activities will not end," added Hossain, also managing director of Sahidullah Securities.

A top official of a leading listed drugmaker said on condition of anonymity that companies are not bound to issue disclosures by the law if their plans are not implemented within the stipulated time.

However, the official said listed companies should inform investors regardless.

"It's a question of good governance and responsibility from the company's side."

According to the rules, listed companies must provide updates on price-sensitive disclosures whether they implement them or not. However, they can do so in various ways, such as by reporting it in financial reports, and are not required to file another disclosure.

The official recommended the government make changes here, saying if a company failed to implement plans, it should be required to issue another disclosure.

Mohammad Rezaul Karim, an executive director and spokesperson of the BSEC, said the regulator would take action against such companies if they do not provide updates through disclosures soon.

Stock exchanges are also responsible for monitoring listed companies. Bourses can identify those who are not implementing the plans presented in disclosures and inform the main regulator to take action, he added.

Sattique Ahmed Shah, chief financial officer and acting managing director of the DSE, said it is difficult for stock exchanges to monitor these issues due to a lack of manpower.

However, not all cases are necessarily malicious.

For example, in 2021, BD Finance announced that it had signed a deal with US-based Sovereign Infrastructure Group (SIG) to attract $2 billion worth of investment in infrastructure projects over two years.

Within six months of the announcement, the company's share price doubled to Tk 69.

But three years on, the investment has not materialised and the company's shares are now trading for just Tk 11.

Md Kyser Hamid, managing director and chief executive officer of BD Finance, said the company invited the then BSEC chairman and some government officials to an agreement signing ceremony and the chairman unofficially provided the news to several newspapers.

"The chairman told me that it would provide a positive vibe to the whole stock market. So, he disclosed it in the media."

After that, the DSE sent a notice asking about the issue and why the news had suddenly appeared in the media.

In reply, the finance company sent the DSE the details of the MoU, which was later published as part of a price-sensitive disclosure, he said.

He also elaborated on why the deal fell through.

"When we signed the MoU, it was determined that the rate would be the Secured Overnight Financing Rate (SOFR) and 4 percent. At the time, the SOFR was 0.59 percent," he explained.

"Later, the SOFR rose to 5 percent. So, if we took the loan, it would be a huge burden for the company. As a result, we refrained from taking the loan and tried to get funds in the form of equity. However, it is very challenging to get funds in the form of equity."

The Daily Star approached Deshbandhu Company Secretary Liakat Ali for comments, but he did not answer phone calls or reply to queries through email and text messages.

Md Azaharul Mamun, company secretary of Sea Pearl Beach Resort, said he was unable to comment on the issue.

Its managing director Aminul Haque Shamim's phone was found switched off. He did not reply to messages despite seven days having passed since he was initially contacted by The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments