A third of NBFIs hold over 73% of bad loans

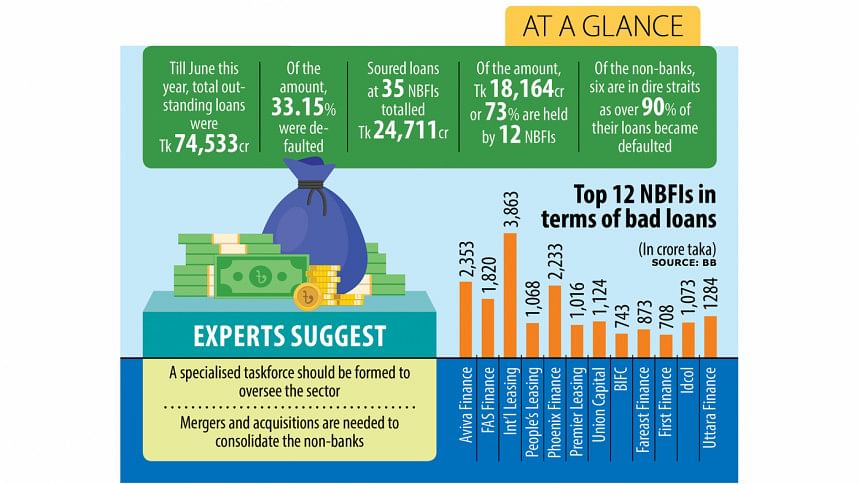

Twelve non-bank financial institutions (NBFIs) out of a total 35 are holding nearly 73.5 percent of the sector's bad loans, according to Bangladesh Bank data, reflecting a precarious situation at those entities.

As of June this year, soured loans at the 35 NBFIs in the country totalled a record Tk 24,711.28 crore, with Tk 18,164.5 crore concentrated in 12 NBFIs, central bank data showed.

The NBFIs are Aviva Finance, FAS Finance, International Leasing, People's Leasing, Phoenix Finance, Premier Leasing, Union Capital, Bangladesh Industrial Finance Company Limited (BIFC), Fareast Finance, First Finance, Infrastructure Development Company Limited (Idcol) and Uttara Finance.

According to industry insiders, the situation is dire for six of these NBFIs as nearly all their loans have soured.

Central bank data shows the proportion of bad loans at FAS Finance, International Leasing, People's Leasing, Union Capital, BIFC, and Fareast Finance is more than 90 percent of total disbursed loans.

Anis A Khan, former chairman of the Association of Bankers, Bangladesh (ABB), said some banks and NBFIs have fallen victim to an "unholy nexus", which he described as a "serious threat" to the integrity of the overall financial system.

"Besides, several other NBFIs have been infiltrated by unscrupulous investors who have exploited their positions as chairpersons and directors for personal gain," Khan said, comparing these actions to "outright theft" that has pushed several NBFIs to the "edge of collapse".

Khan cited examples like People's Leasing, Phoenix Finance, and International Leasing, which he said are severely affected.

He said several factors are contributing to the increasing non-performing loans (NPLs) in the NBFI sector, including scams and irregularities.

Referring to a BB probe report, he said PK Halder, the former managing director of NRB Global Bank (later renamed Global Islami Bank), alone swindled at least Tk 3,500 crore from four NBFIs -- People's Leasing, International Leasing, FAS Finance and BIFC.

As a result, the four NBFIs have become ailing institutions, with more than 90 percent of their loans going bad.

As of June 2023, the sector's total outstanding loans stood at Tk 74,533.74 crore, of which 33.15 percent were defaulted, BB data showed.

However, industry insiders believe the actual amount of bad loans could be even higher, saying defaulted loans tend to increase after inspections by the Bangladesh Bank.

Even amid this, Khan said some NBFIs, such as IDLC, Delta Brac Housing, IPDC Finance and Lanka Bangla, are performing well. "But unfortunately, many others are in a very precarious state."

As a remedy, Khan suggested forming a specialised taskforce and bringing in experts to oversee the sector.

He also advocated for mergers and acquisitions to consolidate the NBFI sector, arguing that the country does not require 35 NBFIs. "What is essential," he said, "is stronger governance and regulatory oversight."

Regarding the bad loans in the NBFI sector, Md Golam Sarwar Bhuiyan, chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA), said the financial health of the NBFIs has not worsened abruptly in recent years. Rather, they have been in dire straits for many years.

"This is like carrying bad loan legacies," said Bhuiyan, adding, "Conditions of the ailing NBFIs are worsening day by day as they have to pay interest on their old bad loans.

"Now, we are trying to find a solution.

In the past 15 years, we have not been able to do anything. There is good governance now. Now, we are trying to find a way to bring back order," he added.

Wishing anonymity, some industry insiders said that the Bangladesh Bank was also responsible for the ailing NBFIs as the central bank's supervision was not up to the mark.

As a result, frequent reports of scams and loan irregularities were reported in the sector over the last few years.

Bhuiyan said they had already met with the central bank governor and discussed the problems plaguing the NBFI sector.

"We urged the Bangladesh Bank to form a separate commission to establish good governance and resolve issues like NPLs in the sector," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments