Policies that could help break the inflation cycle

Inflation in Bangladesh is frequently discussed in the media and on social media platforms. Terms like "galloping inflation," "rising cost of living," "price gouging," and "kitchen garden on fire" highlight the issue's prominence. Many people experience distress and sleepless nights due to rising prices, indicating the severe impact of inflation on daily life.

As the next national elections approach, any government taking power would do well to prioritise the cost of living crisis. Addressing inflation should be a key focus, ensuring strategies are in place to alleviate the financial burden on citizens. The urgency of this issue cannot be overstated, as it is crucial for effective governance going forward.

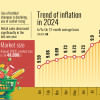

Inflation has been a constant issue in Bangladesh, with little history of zero inflation in past years. Following the fall of the Awami League regime on August 5, there are expectations that the interim government will prioritise inflation control, moving away from the corrupt practices of the past 15 years. In response, Bangladesh Bank raised the policy interest rate and announced measures to halt money printing for government loans while aiming for better fiscal and monetary balance.

On November 17, Prof Muhammad Yunus emphasised efforts to lower inflation, highlighting actions like high interest rates, removing LC limits on grain imports, and improving supply chains. "Efforts are underway to curb extortion in the supply chain, which we hope will help reduce market prices," Dr Yunus added.

Controlling inflation is challenging, as seen in the last 50 years of global economic history. Following the Covid disruptions in 2020, nearly every country experienced double-digit inflation, prompting central banks worldwide to raise interest rates to dampen demand. However, progress has varied, and not all G7 countries have achieved price stability.

Recently, major newspapers reported Bangladesh's decision to raise policy rates to combat inflation, which is encouraging but often has mixed results. Except for a few upper-income families, the increase in the prices of everyday items such as rice, poultry, eggs, sugar, cooking oil, LNG, salt, and onions has burdened family budgets over the last few years. There is hope that the Consumer Price Index (CPI) will trend downward in the coming months, providing relief.

Yet, as the saying goes, "Inflation has nine lives," suggesting it never truly disappears.

Policymakers should aim for three key milestones: 1) reduce inflation to the pre-Covid level of 5 percent; 2) transition to "inflation targeting;" and 3) adopt a framework to manage inflation expectations for stabilisation.

These ideas are not entirely new, and scepticism may arise. Let me briefly review them.

According to the IMF, more than 40 countries currently use inflation targeting as a key component of their monetary policy. Many central banks in advanced economies also incorporate elements of inflation targeting, even if they don't officially label themselves as such. "Full-fledged inflation targeters are countries that make an explicit commitment to meet a specified inflation rate or range within a specified time frame, regularly announce their targets to the public, and have institutional arrangements to ensure that the central bank is accountable for meeting the target," wrote Sarwat Jahan, a senior economist at the IMF's Asia and Pacific Department.

Under an inflation-targeting framework, the Bangladesh Bank could aim for 5-7 percent inflation by 2026 and 3-4 percent by 2028. Although the path may be initially challenging, Bangladesh Bank's forecasting accuracy and the quality of Bangladesh Bureau of Statistics (BBS) data should improve over time. One major hurdle is maintaining consistency and transparency.

Previously, the central bank raised the inflation target for the 2023–2024 fiscal year to 7.5 percent, accommodating high consumer prices but likely raising inflationary expectations. Critics argue this worsened economic conditions, contributing to the civil unrest we witnessed before the fall of the AL regime.

Admittedly, the tools available to Bangladesh Bank to bring down inflation at this juncture are limited. The Executive Director (Research) of Bangladesh Bank Dr Sayera Younus said it is not possible to reduce the price of goods only with monetary policy. Although the central bank has changed the policy rate about nine times, its impact on the market is not significant. For this reason, the government should strengthen monitoring activities at the local (wholesale) level, she said.

Business leaders have voiced their worries about shortages of raw materials in factories owing to the curb on the opening of letters of credit for imports, the gas and electricity crisis, and labour unrest. In various reports from the outlying areas, we have noticed that farmers have similarly pointed out the high cost of seeds, fertiliser, equipment, and fuel. The cost of hired labour has also gone up in rural areas along with CPI.

Syndicates and price collusion also play a role in inflation. The Dhaka Chamber of Commerce and Industry acknowledged that middlemen's margins can cause substantial price increases, with rice prices rising by 307 percent due to trading changes. Research has shown that syndicates and seller collusion mechanisms during economy-wide cost shocks have acted as implicit coordination mechanisms for firms to hike prices.

The Bangladesh Bank and government agencies must work hand in hand to address price gouging. Another emerging concern is how implicit coordination among syndicates lead to "sellers' inflation" and the transmission mechanism for cost shocks (e.g. rise in import prices) to price hikes at the wholesale level.

The central bank should strengthen its communication strategy to clarify policy decisions and their expected effects on inflation, thereby managing expectations more effectively.

The central bank should also improve its regular inflation expectations survey to better understand and manage expectations. Currently, the Bangladesh Bank and BBS surveys lack questions about inflation persistence and uncertainty. Enhancing inflation expectations surveys will also provide better insights, especially regarding crucial sectors like food and the kitchen market.

Dr Abdullah Shibli is an economist and works for Change Healthcare, Inc., an information technology company. He also serves as senior research fellow at the US-based International Sustainable Development Institute (ISDI).

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments