Penalty less than illegal gains fuels stock manipulation

While fines are intended to deter future offences, questions remain over their effectiveness if the amount is lower than the illegal gain.

This is particularly evident when it comes to the Bangladesh Securities and Exchange Commission (BSEC), which continually sees repeat offenders on its penalty lists.

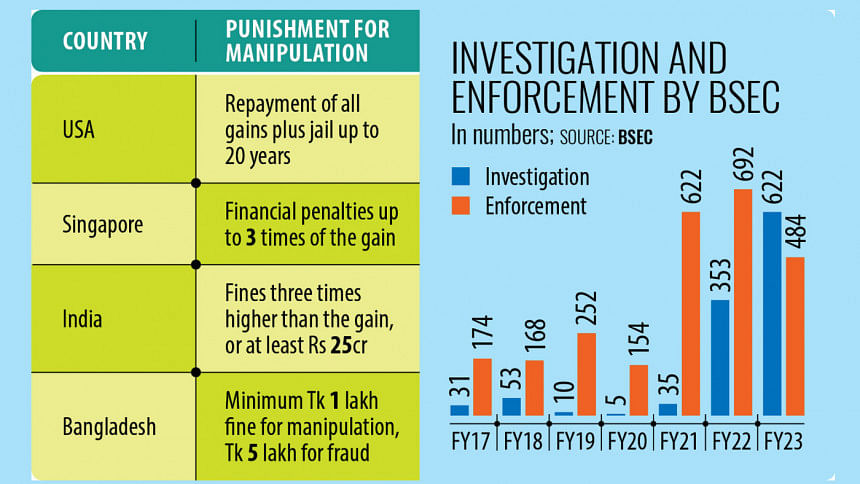

Market experts say that penalties handed down by the BSEC over share price manipulation are tellingly lower than the global practice of the fines being two to three times higher than the illegal gains.

This discrepancy, they argue, enables some individuals to engage in the malpractice year after year even after facing punitive measures.

Unlike other countries, Bangladesh's securities rules do not specify a ratio between the fine and the gains from a contravention.

As a result, the BSEC often imposes lower penalties, enabling manipulators to retain a portion of their illicit gains even if they pay the fine.

The provision for the minimum fine for share price manipulation has remained the same for over 30 years, even as the market saw massive crashes in 1996 and 2010. In 1993, the regulator last increased the minimum fine from Tk 10,000 to Tk 1 lakh.

According to official data, the commission took up punitive measures over 174 cases in fiscal year 2016-17. It rose to 622, 692 and 484 in FY 21, FY 22 and FY 23, respectively.

However, certain individuals who made the headlines over stock manipulation time and again, such as Abul Khayer Hiru and his associates, continued to be involved in multiple share manipulation schemes.

For comments, The Daily Star approached Hiru over the phone, but he was not available.

STRINGENT PUNISHMENTS IN OTHER COUNTRIES

The severity of fines for share manipulation varies across different countries. In the United States, individuals who profit from insider trading can face up to 20 years in prison per violation while their ill-gotten gains are seized.

When determining penalties, the US Securities and Exchange Commission considers factors like the amount of illegal gain and the offender's criminal records.

The Monetary Authority of Singapore (MAS) can impose civil penalties of up to three times the gains or loss avoided from rule violations. The minimum penalty is $50,000 for individuals and $100,000 for corporations.

The Securities and Exchange Board of India (SEBI) can slap penalties of up to ₹25 crore or three times the gains made from fraudulent and unfair trade practices, whichever is higher.

'TK1-TK2 LAKH NO LONGER EFFECTIVE'

Saiful Islam, president of the DSE Brokers Association (DBA), said higher penalties can help reduce market manipulation schemes in Bangladesh.

He said while the country's regulations allow for fines up to three times the illegal gains, disputes often arise over the calculation of these profits.

Transparent and unbiased investigations by the BSEC are crucial to accurately determine the extent of manipulation and the gains made by the offenders, said Islam.

He suggested that the securities ordinance be revised to increase both the minimum and maximum penalties to ensure a stronger regulatory framework.

"A fine of Tk 1 lakh or Tk 2 lakh is no longer effective," he said.

"Without adequately penalising culprits, manipulation will not be controlled," said Ershad Hossain, managing director and CEO of City Bank Capital Resources.

Hossain said punitive measures should be strong for all stakeholders, including auditors and credit rating agencies, to instil discipline in the market.

The CEO of the investment service provider commented that the new commission has increased the amounts in the fines it hands down and can now send a strong message about its commitment to taking stringent action against future contraventions.

He, however, suggested that the BSEC should gradually impose stiffer penalties to avoid negative market reactions and focus on issuing stern warnings.

NO COMPROMISE ANYMORE: BSEC

Mohammad Rezaul Karim, spokesperson of the BSEC, said the new commission is imposing penalties based on the severity of offences and unrealised gains, sometimes close to 100 percent.

In contrast, previous penalties were often much lower than the gains from manipulation and the regulator had almost ceased penalising manipulators during the last couple of years, he said.

Karim is optimistic that their recent actions will improve market governance.

The new commission has quickly taken punitive measures based on investigations initiated by the previous commission, he said. "The regulator wants to send a clear message—we will not tolerate manipulation anymore," he said.

Apart from share price manipulation, the stock regulator can impose fines for fraudulent activities under a securities and exchange ordinance.

For fraudulent activities, the maximum penalty is five years of imprisonment, a fine of at least Tk 5 lakh, or both. This punitive measure was last revised in 2000.

However, punishments for stock fraudulence incidents are less frequently handed down compared to those for manipulation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments