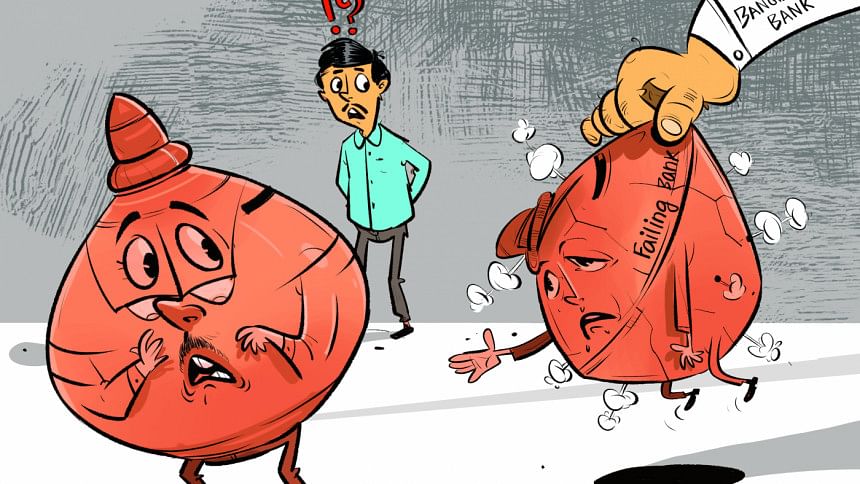

Will merger help solve the weaker banks’ problems?

Banks are an essential part of a nation's economy, facilitating the flow of funds from surplus units (depositors) to deficit units (borrowers) to fuel economic growth. The balance sheet of a bank has two sides: assets and liabilities. Assets are financed by two sources of funds: debt capital (liabilities) and equity capital (owners' equity). According to Basel III, a bank's capital must be at least 12.5 percent of its risk-weighted assets.

Banks with higher capital have higher loss absorbency. Suppose, Alpha Bank has assets of Tk 100 financed by a debt capital of Tk 85 and equity capital of Tk 15. If it lends out Tk 100 and ends up with a 15 percent loss, the whole amount of its capital will be wiped out because the loss is first compensated by capital. If the loss is more than 15 percent, the bank will be insolvent. If the loss is less than 15 percent, say, 10 percent, the bank will still be left with an equity capital of Tk 5. Thus, the greater the risk of loss, the more capital a bank should hold. However, if the loss is unusual, capital is not enough to protect a bank from failure.

There are four main reasons why banks fail: credit risk, interest rate risk, foreign exchange risk, and bank runs. A bank fails when the market value of its assets declines below that of its liabilities, and so the market value of its capital becomes negative. Losses are initially adjusted against capital. When losses exceed capital, a bank becomes insolvent, faces a serious liquidity crisis, and fails to meet the immediate demand of its customers. The ultimate result is bank failure. In Bangladesh, there is no case of bank failure, although many banks would have failed if not rescued.

For example, the Oriental Bank Ltd, founded in 1987, reached the point of failure because of insider lending, corruption and mismanagement. However, the Bangladesh Bank (BB) dissolved the bank's board in 2006 and floated a tender to sell its majority shares in 2007. The Swiss ICB Group purchased the majority of shares, and in 2008, the bank was rebranded as the ICB Islamic Bank Ltd. It has been operating in Bangladesh since then, and has turned into one of the worst performing banks.

Another story revolves around the Bank of Credit and Commerce International (BCCI), which was founded in 1972. Amid massive irregularities and mismanagement, the bank collapsed in 1991. Its Bangladesh wing was also affected, but then BB came to its rescue. After restructuring of ownership, the Eastern Bank Ltd was established in 1992 with 100 percent Bangladeshi ownership. It has been operating successfully, being one of the well-performing banks.

One bank's failure may introduce a systemic risk through which solvent banks may also fail when their customers panic and quickly withdraw their deposits. When there is a crisis of trust, it becomes difficult for some banks to continue operating. Bank failure is different from that of other institutions, because it has serious economic, political and psychological consequences. Hence, governments in Bangladesh have always tried to avoid it by injecting public funds.

Almost every government in the country has licensed some banks over time on political considerations, ignoring their economic justification. Some of those banks could not attain financial viability; faced with enormous amounts of non-performing loans (NPLs), they failed to maintain the required provisions and capital. Merger was warranted repeatedly for such banks, but it was not allowed. These banks ran with the mounting scope of failure.

Merger takes place when two or more companies combine together to form a new company in order to reduce competition, increasing their market shares. It helps strengthen capital base and asset size. The ultimate objective of merger is to drive up revenue, reduce costs, and improve operational efficiency. Banks are merged to curb NPLs, and it is generally voluntary. If two banks merge together, it is believed to be mutually beneficial to the buying bank (the bidder) and the selling bank (the target). The effect of merger can be understood by how this news is reflected in share prices in case the companies are listed in the stock exchange. Empirical evidence shows that in the short run, the target gets benefit. The bidder usually gets benefit in the long run.

However, the question remains about the validity and reliability of data, based on which a selling bank will be evaluated. There is a massive mismatch in the NPLs reported by individual banks and identified by the central bank. The valuation of collateral is also controversial. The riskiness of assets that determines capital adequacy is also underrated. Here, the bidder must face problems in evaluating the target. An erroneous assessment will lead to a wrong conclusion on merger.

Mergers should be based on economic rationality. Its prospect has to be judged based on the data on asset quality, profitability, liquidity, capital, etc. If a strong bank feels that merger will bring benefit to it, only then it may proceed. The bank intending to be merged will show its interest and the good performing bank intending to buy it will make financial and non-financial analyses. If these analyses justify overall benefit, then merger can be carried out.

Since merger appears sensible now, BB cannot discount its own responsibility as it grants banking licence. How did it justify licensing the banks that later turned weak and are now looking for merger? Did they not understand that the economy is not fit for so many banks (there are 61 banks in Bangladesh at present)? There are always points of disagreement between BB and the government. It must be prudent in licensing a bank. If it fails ex ante in this case, it must face problems ex-post—as is now.

There is no doubt that our economy is overbanked, and the number of banks must be reduced. If good performing banks are not interested in merger, considering it may deteriorate their performance, BB may persuade them further, but not order. If merger cannot be made to happen, weak banks should be allowed to wind up reducing further losses. Some banks have such chronic problems that capital injection will not save them. BB will have to develop a well-thought-out plan for their decent exit. In shutting down the banks, it must be guaranteed that their clients will get their funds back in the shortest possible time. It is also necessary to identify and punish the perpetrators of weak banks because of whom they reached such a state.

For a merger to be effective, financial reports must be correct. Weak banks have to be identified objectively, although there is always doubt about it. Different powerful groups will put pressure to keep their banks off the list of weak banks. BB must proceed very carefully in this matter. It should be remembered that the experience of merger between Bangladesh Shilpa Bank and Bangladesh Shilpa Rin Sangstha to form Bangladesh Development Bank Ltd in 2009 did not prove successful. This bank had the NPL rate of 41.37 percent in 2022, although a key objective of this merger was to reduce NPLs.

It is appreciable that the regulators and the government have realised that the number of banks in the country needs to be rationalised. There must be some appropriate ways to reduce the number so that the economy can present a healthy environment to the banking sector.

Dr Md Main Uddin is professor and former chairman of the Department of Banking and Insurance at the University of Dhaka. He can be reached at [email protected]

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments