Delaying key measures may prove costly for economy

In the past 18 months, Bangladesh has largely failed to take appropriate measures to curb higher inflation and reverse the fall of foreign currency reserves, both at the heart of the country's persisting economic plight.

Some measures, under pressure from the International Monetary Fund (IMF), have been introduced, but they have fallen short of meeting the needs of the time and thus bringing in expected outcomes.

The current stance on the part of the policy-makers and the central bank will continue until the national elections, due in January, take place as they don't want to initiate any steps that may put short-term strain on the economy.

But economists say the delay may worsen macroeconomic conditions further, warning that waiting until the elections for key measures might be costly for the country, which has been reeling under pressure stemming from external factors such as the Russia-Ukraine war and higher commodity prices, and internal factors such as persistently high consumer prices and falling forex reserves.

They called for immediate interventions to stop the erosion of the reserve, whose level has halved since August 2021.

An IMF mission, which wrapped up its 16-day review of the $4.7 billion loan on Thursday, said monetary tightening, supported by neutral fiscal policy and greater exchange rate flexibility, is needed to restore near-term macroeconomic stability.

"Who will come to the government or who will not come is linked with the democratic process. However, the administration will have to ensure that the economy functions properly, moves forward, and reduces stress," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

He warned that as the reserve is dropping by around $1 billion each month, if the government waits further when it comes to taking required measures, it would stand at $13-14 billion after three to four months.

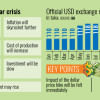

The country had forex reserves of about $40.7 billion in August 2021 and $33.4 billion at the end of 2021-22, according to a document of the IMF. It stood at $20.96 billion on Wednesday, figures from the BB showed.

Elevated commodity prices and synchronous global monetary policy tightening have led to a persistent balance of payments deficit, weighing on foreign exchange reserves, said the WB.

Inaction over making the exchange rate market-based is also hurting the economy. Although the taka has fallen nearly 28 percent against the US dollar since February last year, making imports expensive, effective steps are still absent.

"If the exchange rate becomes market-based after three to four months and any turmoil surfaces, the government will not have enough scope to stabilise it. So, it is risky to wait," Hussain said.

"In order to increase foreign currency supply, the exchange rate should be market-oriented. Further delay will increase the risks. They are taking more risk by waiting."

"But if the central bank takes the right steps now and the problems ease, it will benefit the government and give them satisfaction. So, why wait?"

Currently, the exchange rates are being set by the Association of Bankers, Bangladesh (ABB) and the Bangladesh Foreign Exchange Dealer's Association (BAFEDA) at the unofficial directive of the central bank. This means the rates are still regulated.

"This system is not working well," Hussain said.

"The central bank is planning to take measures after the elections. In the present economic condition, the economic cycle and the political cycle should not be mixed up. We don't have time to wait for a political cycle," said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

"Macroeconomic stability should be the main priority now. If the reserve keeps falling at the current pace and steps are not taken on time to reverse the flow, macroeconomic indicators may deteriorate further. There are no other options and there is no other way to make delays."

He said the stress on the external balance and the reserve is the main source of all macroeconomic problems.

High inflation is being observed due mainly to supply-side disruptions as letters of credit (LCs) could not be opened. To give a boost to the reserve, remittance can play major role in a short period of time while export earnings depend on many issues.

"Remittance is a low-hanging fruit and it can increase fast. To bring remittance, a market-oriented exchange rate should be launched."

As some depreciation of the taka has been allowed recently, the flow of funds transferred by migrant workers increased in the first 15 days of October.

But the flow has not been enough if the record number of workers who have gone abroad in recent years is taken into account.

Remittance inflows dropped to a 41-month low in September to $1.34 billion. It came although more than 11.35 lakh Bangladeshis left the country for jobs abroad last year, nearly doubling from 6.17 lakh migrant workers who flew to other countries the previous year.

"If remittances can be stimulated further, a positive impact will be seen in the foreign exchange reserve," Rahman said.

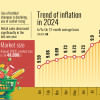

Inflation fell 0.29 percentage points in September from the previous month, but it is still as high as 9.63 percent. Consumer prices have remained at a higher level since the war broke out in February last year.

Inflation is likely to remain elevated in the near term and pressure on the external sector is expected to persist in the Bangladesh economy in the current fiscal year, according to the WB.

In order to tame inflation, the government has fiscal tools and it should focus on the market management like controlling syndication, said Rahman.

He said reforms regarding default loans and capital flight can start after the election.

Both Hussain and Rahman recommended making the interest rate market-based and welcomed the recent measures to this effect.

In June, the central bank withdrew the lending rate cap, which was in place since April 2020.

It implemented a unified exchange rate in September and raised the policy rate by 75 basis points to 7.25 percent in the current month, paving the way for the lending rate to go up and reflect reality.

Prof Atiur Rahman, a former governor, backed the central bank measures.

He added: "The monetary policy should remain contractionary. Efforts should continue to make the exchange rate flexible through innovative ways."

For instance, he said, the central bank can allow banks to offer incentives to bring more remittances through formal channels since nearly half of the funds transferred by migrant workers are channeled via informal channels like hundi.

The government is already giving a 2.5 percent incentive.

"Thanks to the additional incentive, the exchange rate for remittances will come closer to the market rates."

The economics professor thinks the central bank has already depreciated the local currency and remitters and exporters are benefitting from the measure.

"So, remittance and export inflows may rise in the coming months."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments