Uncertain bets: bad stocks rule the roost

If investors hold the stocks of well-performing companies, they are usually awarded better returns since firms with strong fundamentals fare well and pay healthy dividends and their market value rises. The standard appeared to be the opposite in Bangladesh between January and April.

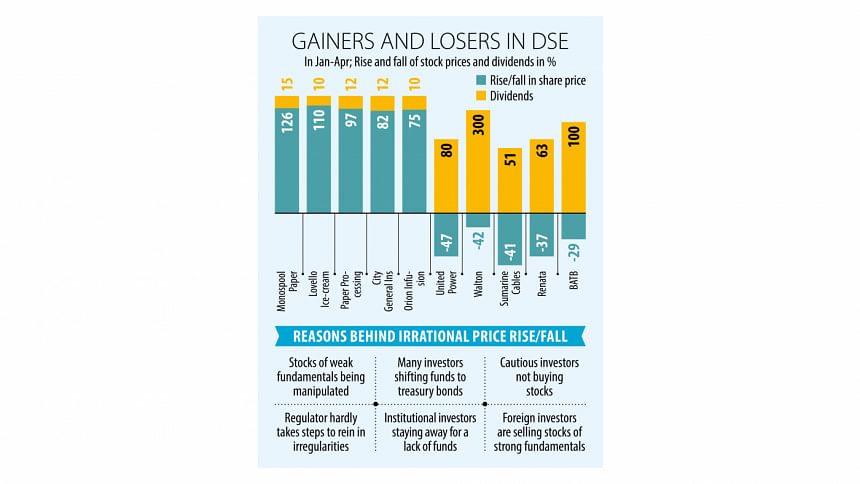

Investors who owned the issues of good companies that provided at least 50 percent dividend in their last financial year incurred losses in the first four months of 2024. On the other hand, people who bet on low-performing companies, which declared less than 15 percent dividends, saw their portfolio inflate.

It came as the stocks of United Power, Walton, ACI, Renata, British American Tobacco, and Bangladesh Submarine Cables plummeted more than 30 percent in the four-month period. Grameenphone shares shed 17 percent.

In contrast, Bangladesh Monospool Paper Manufacturing, Taufika Foods and Lovello Ice-Cream, Paper Processing, Khan Brothers PP Woven Bag, and Beach Hatchery surged more than 50 percent, handing an unusual return to their holders in a market struggling to retain investors.

The disappointing stock market performance of good companies has left Nur Mohammad, a banker and a trader, upset since his portfolio, which includes shares of BATBC, Walton and Square Pharmaceuticals, did not yield the level of returns he had expected.

"Analysts always say if you invest in good stocks, you will never lose money. I always listen to their advice and I have invested in good companies, but the value of my portfolio has fallen by 20 percent."

He alleged that some of his friends purchased the stocks of Lovello after a rumour went around that manipulators would drive up its price. The rumour turned out to be true and the share soared 30 percent.

"How will a good investor stay in such a manipulation-driven market? It is not a market for good investors," Nur Mohammad added.

United Power Generation, a blue-chip company that paid 80 percent cash dividend in its last financial year, dropped 47 percent in January-April while electronics giant Walton, which provided a 300 percent cash dividend, dipped 42 percent.

Stocks of ACI, a well-known company that owns several popular brands and provided 40 percent cash dividend, gave up 46 percent. Renata, one of the top pharmaceutical companies in Bangladesh, gave a 62.5 percent cash dividend in its last financial year and its shares fell 37 percent.

The shares of British American Tobacco, a top multinational company, went down by 30 percent. It provided a 100 percent cash dividend last financial year.

Overall, the DS30, the index that shows the ups and downs of blue-chip stocks on the Dhaka Stock Exchange, dropped 8 percent to 1,995 between January and April.

On the other hand, Bangladesh Monospool Paper Manufacturing, a low-paid-up capital-based company that provided a 15 percent dividend, topped the gainers' list in the four months rocketing 126 percent.

The second-highest gainer was Taufika Foods and Lovello Ice-cream PLC, with its shares more than doubling. Paper Processing & Packaging doubled as well.

Lovello paid a 10 percent dividend in its last financial year and it had no record of awarding more than 12 percent in dividends. Paper Processing gave a 12 percent cash dividend last year.

Prof Abu Ahmed, a former chairman of economics department at the University of Dhaka, said the market has behaved like a casino in the past two years.

"Under-performing stocks are rising continuously. This cannot happen in a healthy market."

He said the market behaviour has been abnormal, so most investors are chasing the shares at the centre of price manipulation. "The shares that regularly top the gainer and turnover lists are full of this type of scrips."

Prof Ahmed thinks only manipulation can push up the prices of low-performing stocks to a higher level. "Unfortunately, the regulators have turned a blind eye to manipulation."

Since the market is not functioning as per the rules, good investors are selling their shares and leaving the market. Thus, even though good companies posted higher profits in their last quarter, their shares fell.

"The investors are trying to leave the market by any means," Ahmed said.

Data from Central Depository Bangladesh Limited (CDBL) showed that the number of beneficiary owners' accounts dropped by 20 lakh, or around 14 percent, in the last two years.

Saiful Islam, president of the DSE Brokers' Association, blamed the lack of governance in the market for the spike of low-performing stocks and the dip in the value of good shares, including multinationals.

He said when underperforming companies climb abnormally, the regulators should step in and try to identify and punish the persons and companies responsible for the unusual movement.

"Not only the Bangladesh Securities and Exchange Commission but also the stock exchanges should monitor the market by ramping up their surveillance capacity."

Islam argued that companies on a growth trajectory can see an upward price movement even when their earnings are low, but these firms are not in any growth phase.

Another reason is the asset management industry has not thrived in Bangladesh. These companies usually buy sound stocks and make investments for a longer period.

Retained earnings, or reserves, of low-performing companies are low while good companies are sitting on huge reserves, according to Islam of the Brokers' Association.

"When investors see an abnormal price swing, they desert the market. This is exactly what is happening in Bangladesh."

He said young professionals are increasingly losing their interest in the market and will not want to build their careers if the current situation persists.

"When blue-chip stocks bleed, it also disheartens the efforts of bringing good companies to the stock market."

Speaking to The Daily Star, BSEC Spokesperson Mohammad Rezaul Karim said the market price is determined by demand and supply. "Still, if anyone breaches rules, we will take action."

He admits that the trading of some companies appears to be suspicious, and they are being monitored.

Karim said the stocks with good fundamentals and foreign shareholdings had been stuck at the same price level for a long time due to the floor price. "Some of them are currently witnessing sales pressures."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments