Economic stress erodes profits for most listed firms

Most listed companies saw their profits erode in the October-December period last year compared to the corresponding quarter of the previous year, due mainly to higher borrowing costs, persistently high inflation and other macroeconomic stresses.

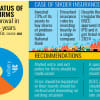

So far, 213 listed firms have published their financial disclosures for the last quarter of 2024.

Of them, 97 companies reported higher profits compared to the same period the previous year, while 116 firms, or 54 percent of the total, saw their profits decline.

Among the 97 profit-making companies, 18 returned to positive territory after previously being in the red. On the other hand, of the 116 firms, 32 incurred fresh losses compared to the October-December period in 2023.

Although the companies recorded an average year-on-year profit growth of 16 percent in October-December, their combined profit was 7 percent lower than in the January-March period last year, according to a compilation by Sandhani Asset Management Company.

However, their combined profits grew by more than 21 percent compared to the politically volatile July-September quarter of 2024.

"Profits of the listed companies fell as the gross domestic product (GDP) growth rate dropped, people's consumption shrunk and inflation remained high," said Rupali Haque Chowdhury, president of the Bangladesh Association of Publicly Listed Companies.

In the July-September quarter last year, Chowdhury said public spending on development works slumped. Besides, the circulation of black money in the economy also declined.

That quarter, the country's GDP grew by only 1.81 percent -- the lowest since the second quarter of the fiscal year (FY) 2020-21 when the Covid-19 pandemic hit the globe, according to the Bangladesh Bureau of Statistics (BBS).

At the same time, industrial output expanded by only 2.13, a sharp decline from 8.22 percent growth recorded a year earlier.

The implementation of the Annual Development Programme (ADP) in the first six months of FY 2024-25 was down 19 percent year-on-year, according to the planning ministry.

"Overall, the business of listed firms mirrored the struggling economy," said the president of the association for listed firms.

Azam J Chowdhury, a former president of the BAPLC, said many industries are not getting adequate energy supply, which has an impact on their business.

On the other hand, there are political uncertainties, leaving entrepreneurs to adopt a wait and see approach for business expansion. It affects job creation. At the same time, consumers are squeezing their consumption.

Meanwhile, Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said business profits were under pressure mainly due to higher operating costs and lower aggregate demand.

As interest rates in the banking sector rose, so did the finance costs for firms. Wages also increased at many companies. However, they were unable to adjust prices amid high inflation, according to Rahman.

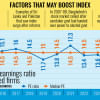

The weighted average interest rate in the banking sector was 6.60 percent on October 1, 2023, which rose by 55 percent to 10.23 percent by the end of December 2024, according to the Bangladesh Bank (BB).

On the other hand, aggregate demand, including public investment-induced demand, took a hit due to high inflation and a volatile political landscape, Rahman said.

"So, all of these factors impacted the bottom line of businesses," he added.

Referring to the latest Purchasing Managers' Index (PMI) by the Metropolitan Chamber of Commerce and Industry (MCCI), he said the economy has been expanding and healing but has not yet reached its previous level.

TOUGH TIME FOR SMALL FIRMS

An analysis of company profits found that large companies were comparatively in a better position, while smaller firms faced tougher conditions.

The combined profits of listed firms grew mainly because some large state-run companies returned to profitability.

These companies returned to profit after incurring huge losses earlier due to taka devaluation, which has since reduced in recent quarters amid a stable foreign exchange rate.

For instance, Power Grid Bangladesh PLC incurred a loss of Tk 114 crore in the October-December period of 2023.

The company had losses ranging from Tk 50 crore to Tk 287 crore in each quarter before logging a profit of Tk 398 crore in the October-December quarter of 2024.

A similar trend was seen for the Dhaka Electric Supply Company Ltd (DESCO).

Azam J Chowdhury said medium-sized businesses suffered the most with limited product diversity.

Large corporates are comparatively in a better position for their diverse portfolio and huge market base, said Chowdhury, who is also managing director of MJL Bangladesh Ltd.

"The law-and-order situation was not up to standard after the regime change, with random movements on roads and labour unrest at many firms causing disruptions in supply chains and logistics management," said Rizwan Rahman, managing director of ETBL Securities & Exchange Ltd.

As a result, profits were impacted, he said.

"The country remains in a high-inflation environment, which has affected consumer consumption, especially for fast-moving consumer goods producers," Rahman added.

The country's inflation fell to 9.94 percent in January from 10.89 percent in December, according to the Bangladesh Bureau of Statistics (BBS), but has remained above 9 percent since March 2023.

BUSINESS CLIMATE MAY REMAIN DULL

Regarding the current business scenario, Rahman, a former president of the Dhaka Chamber of Commerce and Industry, said business activity in the current quarter may remain sluggish.

"Until a democratically elected government comes to power, businesspeople are operating very cautiously," he added.

On the other hand, the government recently raised value-added tax (VAT), which may further impact people's purchasing power. At the same time, businesspeople do not have adequate confidence in the law-and-order situation, which could affect business in the second half of the current fiscal year, he added.

An analysis of business trends found that the past two years have been a rollercoaster ride for businesses, with some companies soaring to new heights while others faced staggering declines. The most significant struggles were seen in the mutual fund sector, followed by the construction sector.

THE COMEBACK KINGS

Power Grid Bangladesh PLC emerged as the biggest turnaround story, moving from a deep loss of Tk 50 crore in the January-March period of 2023 to an astounding profit of Tk 398 crore in the October-December period of 2024.

Square Pharmaceuticals, already a market leader, saw consistent growth, climbing from a profit of Tk 428 crore in the January-March period of 2023 to Tk 660 crore in the October-December period of 2024. Strong product demand and expansion into global markets contributed to this success.

DESCO also made a strong recovery, moving from a loss of Tk 145 crore in the third quarter of FY24 to a profit of Tk 26 crore in the second quarter of FY25, showing a well-executed cost-cutting strategy.

Beximco Pharmaceuticals saw steady growth, from Tk 95 crore to Tk 182 crore, fueled by increasing demand for its pharmaceutical products.

Malek Spinning, which started in the red with a loss of Tk 35 crore, turned things around to close at a profit of Tk 50 crore, likely benefiting from favourable market conditions.

FALLEN FROM GRACE

Titas Gas experienced a massive downturn, dropping from a profit of Tk 39 crore in the third quarter of FY24 to a loss of Tk 522 crore by the same quarter of FY25. Unfavorable policies and operational inefficiencies contributed to this decline.

Beximco Ltd, once a strong performer, fell from a profit of Tk 73 crore in the third quarter of FY24 to a loss of Tk 243 crore in the third quarter of FY25, indicating significant financial setbacks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments