How Bangladesh’s stock market remains an outlier

Most of the global stock indices plunged last March when the war between Russia and Ukraine escalated but they took only two months before bouncing back despite the conflict-induced turmoil worldwide.

The stock markets in Bangladesh too fell after the war erupted but they show no sign of any rebound although more than 10 months have passed since the Russian invasion of Ukraine began.

Analysts blame the confidence crisis among investors triggered by the steps of the Bangladesh Securities and Exchange Commission (BSEC) as the regulator moved to keep the market at a higher level artificially although the price of most stocks was falling.

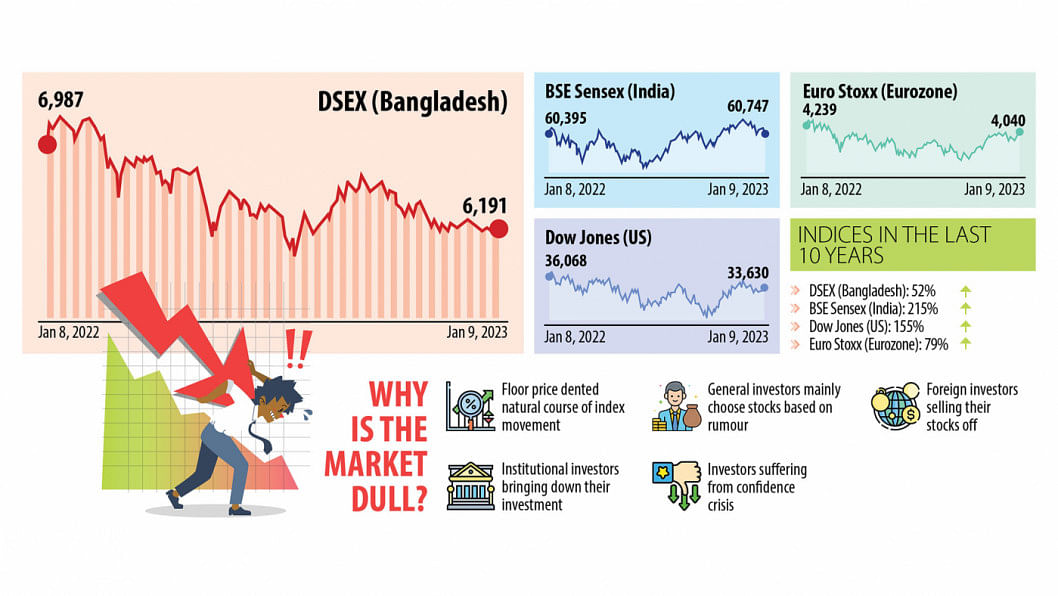

The DSEX, the benchmark index of the Dhaka Stock Exchange, plunged 5.79 per cent between January and March as the war pushed the crude oil price above $120 per barrel, dealing a blow to oil-importing nations such as Bangladesh.

During the same quarter, India's BSE Sensex plummeted 12.50 per cent, Hong Kong's Hang Seng eroded 22.4 per cent, the United States Dow Jones Industrial Average index shed 9.52 per cent, and Eurozone's Euro Stoxx 50 gave up 17 per cent.

Though the war persists, the crude oil price has dropped to $73.77 per barrel. Still, the global stock indices are on an upward trend.

The BSE Sensex climbed 13.3 per cent between March of 2022 and January this year. The Hang Seng Index surged 13.98 per cent, the Dow Jones advanced 3 per cent, and the Stoxx 50 rocketed 14.60 per cent.

But Bangladesh was an exception as the DSEX fell 4 per cent during the same period.

"The movement of Bangladesh's stock market index does not match that of the global market as it is a distorted market," said Yawer Sayeed, managing director of AIMS Bangladesh, the first asset management company in the private sector in the country.

He argued that the price mechanism of the stocks is now artificial because of the floor price whereas stock markets are treated as free globally.

At the end of July, the BSEC set the floor price for every stock to halt the free fall of the indices amidst global economic uncertainty. The floor price was the average of the closing prices on July 28 and the preceding four days.

The regulator lifted the floor price for 169 companies in December. But it has put in place the circuit breaker in a way that prices can't fall more than 1 per cent based on the previous day's closing price in a single day.

"Even analysts can't predict the market trend for the next day as most of the technical analysis is not working here," Sayeed said.

The asset manager says an investor pool that will invest for long term has not evolved in the market. "Rather most of the people are investing for short-term profits and they depend on rumours."

The government's policy support is also conducive for trading, not investment-friendly, he said.

"Margin loan facilities have fuelled day trading instead of long-term investment. So, the market's movement rarely matches the global indices."

Sayeed said all focus is on making the index bullish. "There is no attention on bringing in a qualitative improvement to the market. The regulator should work on it."

In fact, the stock market in Bangladesh did not see any sustainable bull run in the last one decade because of structural problems whereas most global indices have doubled or tripled during the period, said Ershad Hossain, managing director of City Capital, one of the leading merchant banks in the country.

In the last one decade, the DSEX expanded 52 per cent while the Sensex rocketed 215 per cent, the Dow Jones surged 155 per cent, and the Euro Stoxx advanced 79 per cent.

"Whenever the index in Bangladesh rose, a correction followed immediately. So, there has been no major sustainable bull run," Hossain said.

In Bangladesh, the prevalence of institutional investors is low and the contribution of mutual funds is insignificant. The number of well-performing companies is small.

"People are rushing towards speculation-based securities," Hossain said.

He suggested the regulator work on the issues and not intervene in the price mechanism.

"Otherwise, the market loses its natural course."

Some of the leading indicators, including oil and commodity prices, are returning to the pre-war levels, so the indices in the major markets are also rising, said Md Saifuddin, managing director of IDLC Securities.

"Bangladesh's economic condition is in a better position compared to what was expected at the beginning of the war. Hopefully, the stock index would rise soon."

A stock market analyst who deals with foreign investors says Bangladesh's economy bled like other economies, so a decline in the market was expected. But the regulator stopped the fall by bringing back the floor price.

"But the real price movement was not clear due to the new price mechanism," he said, adding that the introduction of the floor price was conceptually a wrong decision.

He said foreign investors are not coming to the market, rather they are pulling out their funds. "That's why we are going through a bearish trend."

Net foreign investments stood at Tk 582 crore in negative in August, which was Tk 139 crore in negative in July and Tk 272 crore in negative in June, DSE data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments