Devalue taka for exchange rate stability

Researchers and economists yesterday suggested that the local currency be devalued further by 10 percent to 15 percent against the US dollar to match unofficial exchange rates and restore market stability.

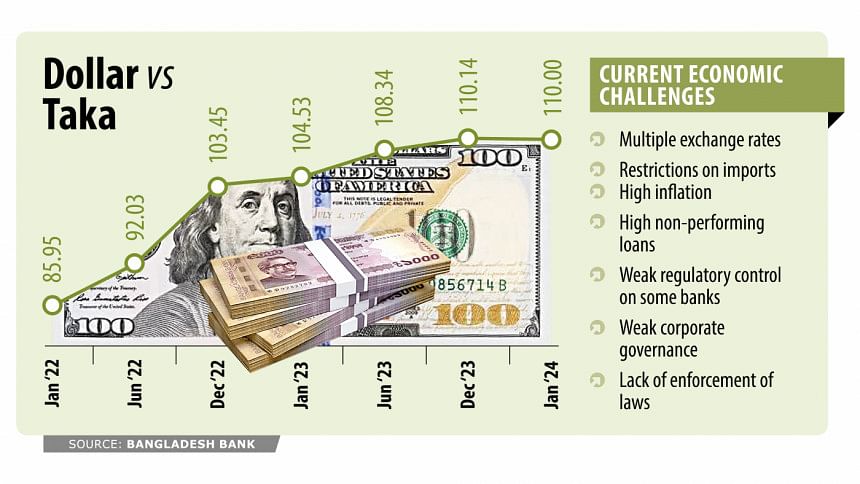

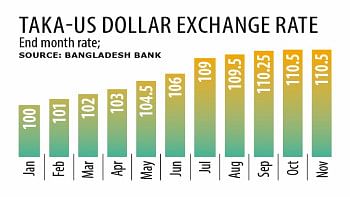

The exchange rate was kept almost fixed artificially till 2022 and it did not follow the market trend. But as the foreign exchange reserves dwindled owing to higher US dollar outflows compared to inflows, the taka has lost its value by about 30 percent in the past two years.

Still, the exchange rate stability is yet to be there.

"The exchange rate situation worsened due to faulty macroeconomic management while the interest rate, inflation and international reserve management contributed to the current crisis," said Monzur Hossain, a research director of the Bangladesh Institute of Development Studies (BIDS), while presenting a keynote paper.

He spoke at a seminar on "Unpacking the Economic Manifesto of the Awami League: Trends and Challenges for Tomorrow's Bangladesh" organised by the BIDS on its premises in the capital.

Speaking at the event, researchers and economists said allowing the Bangladesh Foreign Exchange Dealers Association (Bafeda) and the Association of Bankers Bangladesh (ABB) to fix the exchange rate is unacceptable.

Foreign exchange management must be under Bangladesh Bank's jurisdiction, added the experts.

The analysts also recommended a dynamic exchange rate management with indicative adjustments following the real effective exchange rate (REER) and accommodative monetary policy with interest rate deregulations.

The REER is a measure of the value of a currency against a weighted average of several foreign currencies divided by an index of costs.

"Efficient management of authorised dealers' banks is needed for exchange rate stability," said Hossain.

"Policies to sell foreign currencies through money exchanges need to be revisited while they can be replaced by bank booths."

He said strict enforcement of laws must be ensured against loan defaulters, money launderers and financial irregularities to boost the confidence of customers.

Hossain welcomed the mergers and acquisitions move initiated by the central bank. He, however, warned decisions must be taken carefully and loan rescheduling and write-offs need to be discouraged.

He thinks a banking commission comprising experts, economists and policymakers could be useful in fulfilling reforms in the sector.

"New banks should not be allowed at least for the next five years."

Regarding the current problems of the financial sector, Hossain highlighted the high non-performing loans, inadequacy in capital requirements and the sorry state of a good number of private banks.

He also blamed weak regulatory control over some banks, weak corporate governance in the banking sector, politically active board members and owners and a lack of enforcement of laws.

On the post-pandemic crisis, Hossain cited multiple exchange rates, restrictions on imports, sharp depletion of reserves and rising inflation amidst a depreciating taka as the major reasons.

While presenting a keynote paper, Binayak Sen, director general of the BIDS, focused on nine priority issues for tomorrow's Bangladesh, including educational quality and equality and drawing in more foreign direct investment.

He said more efforts are needed in a shift from import tariffs and trade taxes to direct taxes.

"We need a 15 percent to 17 percent tax-to-GDP ratio to be consistent with the middle-income status and we have to increase the latter at half a percentage point every year."

Planning Minister Maj Gen (retd) Abdus Salam was the chief guest at the seminar's first session titled "Macroeconomic Stability, Fiscal Efforts and Agriculture" while Mashiur Rahman, economic affairs adviser to the prime minister, spoke as the special guest.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments