Money laundering and its effect on Bangladesh’s inflation

The finance minister, in his final speech in parliament on the proposed budget for FY24-25, said: "While it is necessary to adopt contractionary policies to control inflation, it is undeniable that in the long run, this approach can slow down growth."

Inflation, which erodes the purchasing power for consumers as well as businesses, happens in two ways. One is through an increase in the production cost of goods or services, generally referred to as cost-push inflation; the other happens through an increase in the demand for goods and services due to increased supply of money in the market, which is referred to as demand-pull inflation.

When more jobs and higher wages increase people's income level, it leads to a rise in consumer spending. The overall effect is an increase in aggregate demand, which gives firms the opportunity to increase the prices of their goods and services. As soon as this happens on a large enough scale, it leads to an increase in demand-pull inflation.

The current inflation in Bangladesh has not been driven by an increase in the money supply in the market. Rather, a large portion of the active labour force is unemployed or underpaid due to the impact of post-Covid global factors and the war in Ukraine.

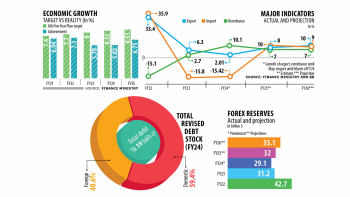

A low unemployment rate is unquestionably good in general, but it can cause inflation because zero or near-zero unemployment means people have higher disposable income. The unemployment rate in Bangladesh was 4.38 percent in 2019, which climbed to 5.21 percent in 2020 due to the pandemic's affects. The unemployment rate dropped to a low of 4.7 percent in 2022. The Ukraine war that started in February 2022 halted the post-pandemic recovery process—and employment generation could not gain much momentum. So, it is evident that low unemployment (or an economy with full employment), which is a cause for demand-pull inflation, is not applicable in the Bangladesh context.

The inflation rate as of May 2024 was 9.89 percent, whereas it was 5.57 percent in January 2020. So, what we have in Bangladesh is cost-push inflation. The devaluation of our currency has led to an increase in the import cost of raw materials, leading to an increase in the overall price level. The official exchange rate of the US dollar against the taka was 84.86 in 2021. It was Tk 103.02 and 109.75 in 2022 and 2023, respectively. Finally, it stood at Tk 117.00 after the introduction of a crawling peg exchange rate.

The value of a country's currency and its exchange rate significantly influences the level of inflation. If a country's currency depreciates, the cost of imported goods affects domestic pricing. Thus, a weaker currency triggers inflation.

To control inflation, the standard response of a central bank would be to raise official interest rates. When the central bank increases interest rates, borrowing for commercial banks becomes more expensive. Both consumers and businesses might think twice about taking loans for major purchases or investments. This slows down spending, typically lowering overall demand, which leads to reduced inflation.

This monetary instrument to curb inflation is best suited for inflation triggered by an excessive supply of money. But in the case of inflation in Bangladesh, it is triggered by a rise in the cost of production, especially due to an excessive rise in the dollar price. In August 2021, Bangladesh Bank had $48.1 billion in foreign currency reserves, which came down to $24.2 billion in May 2024.

Here, it is evident that the higher inflation rate prevailing in Bangladesh is not due to demand-pull inflation; it is due to a shortage of Forex reserves and an increase in the dollar price. So, contractionary monetary policy will not function here as expected.

Increased policy rate and the introduction of a specific margin plus Six-Month Moving Average Rate of Treasury Bill (SMART) as a lending rate will in no way make the economy grow. It will limit the earning capacity of consumers and affect producers, leading them to lower production. Thus, a vicious cycle will take over the economy, pulling the growth rate down or even push it towards negative growth.

Since the current inflation in Bangladesh cannot be most effectively addressed with a contractionary monetary policy, an alternative financial regulatory intervention through the repatriation of overdue export proceeds and curbing money laundering is needed.

In 2022-23, the mismatch between the actual realisation reported by Bangladesh Bank and the shipment figure provided by the Export Promotion Bureau (EPB) was $12.08 billion. EPB data showed that goods and services exports stood at $63.05 billion in FY23, whereas the central bank reported that Bangladesh received $50.97 billion in the same year. There may be some differences between the export data of the Bangladesh Bank and the EPB due to disagreements and the time lag effect. But such a huge gap must be investigated meticulously to find any unrepatriated export amount.

According to Transparency International Bangladesh (TIB), Tk 26,400 crore or $3.1 billion is illegally siphoned out of Bangladesh every year. Reportedly, hundi, over-invoicing, under-invoicing, and trade mis-invoicing are the primary ways of money laundering.

Corruption has a negative impact on the economic growth of any country, as it reduces investment and consequently lowers the growth rate of industrial output. Undoubtedly, corruption is a big hindrance to sustainable development. But it's not the biggest hindrance for an economy. When money acquired through corruption circulates within the economy, it still generates employment and thus contributes to increasing GDP. The biggest hindrance to sustainable development is the money getting laundered abroad. Money, whether earned legally or illegally, once laundered out of the country, is most likely lost forever and will not make any contribution to its economic activities. The damage that this does is massive, which is why it is so vital to stop money laundering in Bangladesh.

Mohammad Jahidur Rahman is adjunct research fellow at the Center for Critical and Qualitative Studies, University of Liberal Arts Bangladesh. He can be reached at [email protected]

Views expressed in this article are the author's own.

This article was published in print on July 21, 2024. Owing to the internet shutdown from the evening of July 18 to July 23, it was uploaded online on July 24, 2024.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments