Expanding Horizons and Future Prospects

Islamic banking has garnered people's attention with robust growth over the last decade as a large number of people in Bangladesh prefer the Shariah-based banking system for their financial transactions. The expansion of Islamic banks has led traditional banks and non-bank financial institutions to launch Shariah-based windows and branches.

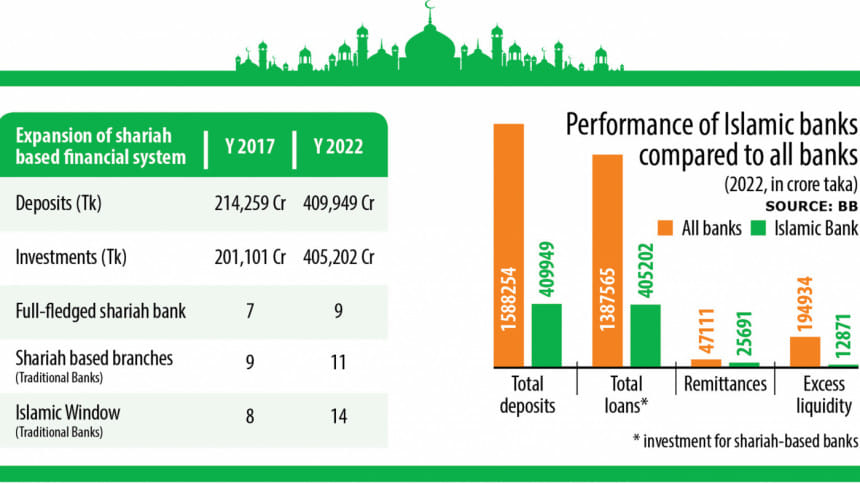

Currently, Islamic banks represent a 25.81 percent share in terms of deposits and 29.20 percent in investments. In 2017, these figures stood at 23.13 percent and 23.81 percent respectively, according to data from the Bangladesh Bank.

Islamic banking possesses several advantages and potentials over conventional banks. However, it also faces certain challenges. When Islamic banking first emerged in Bangladesh, many people believed that the Shariah-based banking concept might not sustain. However, it is now expanding rapidly, with even non-Muslim individuals preferring Shariah-based banking. Zafar Alam, Managing Director and CEO of Social Islami Bank, stated, "Shariah-based banking is best for its better system."

This banking system prioritizes people's well-being, whereas the compound interest rates on lending in traditional banks create significant pressure on entrepreneurs. Additionally, the profit-based participatory policy of Islamic banks attracts businesspeople to obtain financing.

A major challenge is the absence of separate rules for Islamic banking. With the rapid growth of specialized banking, there should be separate regulations for them, remarked Alam.

Though Bangladesh Bank is eager to establish separate legislation, there has been no progress yet. Therefore, it should be given priority, added the top official of SIBL.

Mohammed Monirul Moula, Managing Director and CEO of Islami Bank Bangladesh, stated that the Shariah-based banking system has been expanding at a higher rate. This expansion is not solely driven by religious emotions and significance; rather, it is supported by unique features and mechanisms.

Its economic beauty lies in its need-based and welfare-oriented financial solutions. This banking system promotes socially desirable enterprises while discouraging socially undesirable ones, making business within the banking sector sustainable.

One of its advantages is its asset-based and asset-backed sustainable financing mechanism, which works to promote the green economy. Islamic banking aims to maximize welfare and motivate stakeholders to contribute their best for the well-being of themselves and society, thus reducing discrimination and poverty.

Moreover, the majority of people in our country prefer welfare-oriented Shariah-based banking, which accelerates its expansion, Moula said.

Unlike conventional banking, the relationship between the bank and its clients is not that of a lender and borrower, but rather that of business partners. This is the key to the success of Islamic banking and an advantage of the banking system, he added.

At present, nine banks have full-fledged Shariah-based operations, and eleven banks have opened Shariah-based branches. Additionally, 14 conventional banks offer Islamic banking windows, according to the central bank's latest quarterly report on Islamic banking.

In 2017, there were seven full-fledged Islamic banks and nine banks with Shariah-based branches. Only eight banks had Islamic banking windows.

ABM Burhan Uddin, Head of Islamic Banking at Bank Asia, stated that Islamic banking conducts business in a fair and transparent manner.

It restricts goods and services that are prohibited in Islam, such as alcoholic beverages, alcohol, tobacco, gambling, pornography, etc., which is an advantage of this banking system.

He further mentioned that a challenge remains in realizing investment dues from clients affected by COVID-19 and the Russia-Ukraine war.

Surplus Fund Management is one of the major challenges for Islamic Banks since there is no Islamic money market and Islamic instruments, he said, adding that the lack of skilled manpower is also a challenge for specialized banking.

Uddin recommends establishing an inter-bank money market for Islamic banks and launching more Islamic instruments from the government, such as Sukuk.

There are 35 NBFIs in the country. Among them, Islamic Finance and Investment, Hajj Finance, and Aviva Finance have full-fledged Shariah-based operations. IDLC Finance, DBH Finance, Strategic Finance & Investments, and some other NBFIs have already received approval to launch Islamic windows.

"People are increasingly interested in Islamic banking, especially family-run corporates who are seeking the service to keep their funds," said Mohammad Abdul Hannan, Head of the Islamic Finance Project at IDLC Finance.

IDLC Finance obtained approval to launch a Shariah-based window from the central bank last month. "We don't want to miss out on clients." A major advantage of this banking system is that there is no provision for an interest rate on deposits. Instead, the profit (interest) varies in alignment with the income from investments (lending). Therefore, the pressure of paying profit (interest) on deposits is not felt in Islamic financial institutions.

Since investments in Islamic FIs are deal-based and vary in different situations, the spread remains the same, while in conventional banks, the spread may deviate due to the concept of a provisional interest rate.

It was recently observed that while the deposit rates rose sharply in traditional banks, the interest rates on lending did not, he said.

Regarding the challenges of Islamic banking, he mentioned that Shariah-based banking incurs some extra costs that do not apply to conventional banks. He cited an example of the insurance cost of an asset in which banks/NBFIs invest.

Another example is that traditional banks can impose a 1 percent processing fee on loans, whereas Shariah-based FIs can only impose an exact processing cost ranging from 0.40 percent to a maximum of 0.50 percent, added Hannan.

The Islamic financing system appears increasingly attractive and profitable compared to conventional banks, as the former enjoys the opportunity to maintain a lower statutory liquidity ratio (SLR) and a higher investment-deposit ratio (IDR).

Traditional banks are required to maintain a 13 percent SLR, which is defined as the ratio of a bank's liquid assets to its net demand and time liabilities. In contrast, Islamic banks have a 5.5 percent SLR.

Similarly, the loan-deposit ratio for conventional banks is 87 percent, while the IDR is 90 percent for Islamic banks.

According to S&P Global Ratings in 2021, the $2.2 trillion global Islamic finance industry was expected to grow by 10 percent to 12 percent over 2021-2022 due to increased Islamic bond issuance and a modest economic recovery in the main Islamic finance markets.

The central bank's report on Shariah-based banks stated that other sectors of the Islamic financial industry, such as the Islamic capital market, Islamic insurance (Takaful), and the microfinance sector, can also flourish systematically if supportive policies are adopted and implemented.

Despite the growth of Islamic banking activities in Bangladesh, the number of rural branches of full-fledged Islamic banks has not kept pace with demand.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments