Stocks lose lustre as investment tool

The stock market in Bangladesh is not playing its due role of supporting people looking to diversify their earnings or generate additional income. Similarly, it is not helping those who aim to absorb the shocks triggered by the lingering higher inflation for the past two years.

Since mid-2022 when the stock market regulator launched the floor price to stop the free-fall of shares, almost all scrips were stuck due to the absence of buyers. It was lifted gradually in January and February this year.

As a result, investors, who make investment decisions by analysing the financials and potentials of the listed companies, could barely earn any money during the period.

Their plight did not end there.

This is because since the floor price removal, the stocks have been bleeding owing to massive sell-offs by local and foreign investors as the economic uncertainty persists. Therefore, they did not make any profit even when they finally got the opportunity to trade the securities.

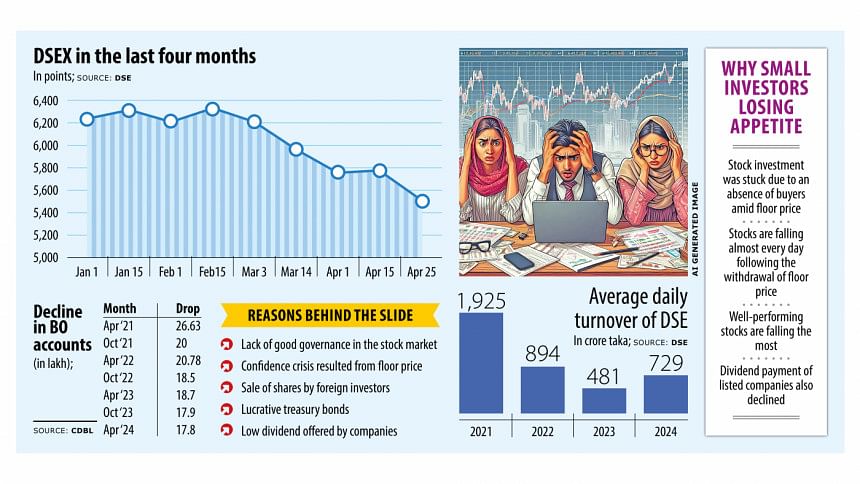

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), stood at 6,200 when the Bangladesh Securities and Exchange Commission (BSEC) began to scrap the floor price in January. It dropped 14 percent, or 929 points, in the last two months.

Before the price control was put in place, the index hovered around 6,000 for one year. Overall, the stock market has failed to yield the expected income for the investors in the last three years.

According to analysts, most of the investors are service-holders and they invest mainly in order to ensure an extra income stream. However, since their investments had remained stuck and their portfolio is losing their value now, this group of people will lose their appetite to remain in the market.

According to Central Depository Bangladesh Ltd, the number of beneficiary owners (BO) accounts dropped by 8.73 lakh, or 32 percent, to 17.88 lakh in the three years to April 24.

Ashiqur Rahman Pinu, an investor, said he had an investment of Tk 30 lakh in the market with half coming in loan from his sister, who lives abroad.

The value of the fund has fallen to Tk 16 lakh even though he has invested in comparatively sound companies and never chased junk stocks.

Pinu said the fund did not give any returns for two years owing to the floor price, so he could not give any profit to his sister.

"Now, the stocks are falling. I am utterly disappointed. Once the stocks rise, I will sell them and leave the market. The investment in the stock market has already created a problem in my family."

The dividend payout of the listed companies also fell in the last two years amid lower profits caused by an increase in expenses since the energy has become costlier, the taka has lost its value by about 30 percent, and the cost of funds has gone up.

In a shocking development, the investors who put their funds in well-performing stocks are seeing a heavy erosion of the value of their investments compared to those who have bet on junk stocks.

The plunge of the DSEX, however, is not portraying the real suffering of the investors since many large, capital-based stocks such as Walton, IDLC, Crown Cement, RAK Ceramics, Titas, and IPDC Finance are not taken into account while calculating the index.

They are not considered since the number of the free-floating shares of these companies was low when the floor price was in place.

Since they lost massively in the last two months, the broader index would have dealt with further slide had they been taken into consideration.

Walton stocks dropped around 20 percent, IDLC fell 27 percent, and Crown Cement was down 21 percent in the last two months. Similarly, RAK Ceramics nosedived 27 percent, Titas Gas plummeted 23 percent, and IPDC Finance dipped 39 percent.

At present, 257 companies, or 68 percent of the firms listed on the premier bourse of Bangladesh, are included in the computation of the DSEX.

Md Shihab Uddin, who works in a private firm, said he invests in the stock market hoping for some extra bucks so that he can meet family expenses smoothly.

"The market gave nothing in the last three years," he said.

Since the investment had been stuck, he had no scope to transfer the fund to other investment tools, he said.

He says when the inflationary pressure remains high, an extra income source is necessary to absorb the price shock.

"From that point of view, my stock market investment has produced nothing."

In Bangladesh, inflation has stayed above 9 percent since March last year.

Md Ashequr Rahman, CEO of Midway Securities, said many of the investors who see the stock market as a source to produce additional incomes are now leaving the market because they are seriously frustrated owing to lower returns.

This group of investors are not daily traders. Rather, they choose well-performing stocks and sell shares partly and withdraw the fund to enjoy holidays and festivals.

The CEO observed that a significant number of genuine investors are going for massive sell-offs and withdrawing funds.

"This means they may not come back to the market."

"Since the removal of the floor price, these stocks have started to fall massively. On the other hand, junk stocks are on the rise. This is the cause of their frustration."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments