World Bank suggests unified exchange rate, further monetary tightening

The World Bank has recommended Bangladesh put in place a unified exchange rate and tighten monetary policy further in order to tame persistently high inflationary pressure and end the foreign exchange crisis.

On Sunday, a team led by Anna Bjerde, managing director for operations for the Washington-based lender, gave the suggestions during a meeting with the top officials of the Bangladesh Bank at its office in Motijheel.

The WB is also aware of the impacts that the poorer section of society may face owing to the prescribed uniform exchange rate and a more contractionary monetary policy. So, the global lender suggested the government strengthen the social protection programmes to give them relief.

The visiting officials also wanted to know about the update on banking sector reform activities and emphasised reducing default loans, which may hurt the growth trajectory of the South Asian country.

Bjerde highlighted macroeconomic and financial sector reforms that are needed urgently to sustain inclusive growth.

"Fast and bold reforms in monetary and fiscal policies will enable Bangladesh to maintain macroeconomic stability, reduce financial sector risks, and sustain inclusive growth amid global uncertainties," she said.

She was accompanied by Martin Raiser, vice-president of the WB for South Asia. BB Governor Abdur Rouf Talukder, Deputy Governors Kazi Sayedur Rahman and Nurun Nahar, and Chief Economist Md Habibur Rahman were also present.

"We talked about the monetary and fiscal policies that are critical to Bangladesh's growth," said Raiser in a post on his X (formerly Twitter) account about the meeting with the central bank.

A source of the central bank who was present in the meeting said the multilateral bank suggested launching a unified exchange rate and more contractionary monetary policy amid escalated inflation and a deeper foreign exchange crisis.

In Bangladesh, multiple exchange rates persist.

But parallel exchange rates are associated with higher inflation, impede private sector development and foreign investment, and lead to lower growth.

At present, the exchange rate is different for remitters, exporters and importers in Bangladesh.

The multiple exchange rates are blamed as one of the major factors for the fast depletion of the forex reserves. This might be because remitters prefer hundi cartels to transfer money to their beneficiaries at home since informal platforms offer better rates than official platforms while exporters may feel tempted to defer the transfer of export proceeds since the taka is said to be decline further.

In Bangladesh, a one-percent deviation between the formal and informal exchange rate shifts 3.6 percent of remittances from the formal to the informal financial sector, the WB said May last year.

Unrealised export proceeds -- the difference between export shipments and realised export proceeds -- increased to $9.6 billion, which amounted to 2.1 percent of GDP in FY23, according to the International Monetary Fund (IMF).

Owing to higher import payments against the lower-than-expected export and remittance receipts, the reserves fell to $20.19 billion on February 20 from about $40.7 billion in August 2021, forcing the local currency to lose its value by about 28 percent against the US dollar in the past two years.

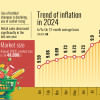

The WB team suggested further tightening of the monetary policy to rein in inflation. Consumer prices are showing no signs of cooling although the BB has opted for a contractionary monetary policy since May 2022.

Last month, it raised the policy rate by 25 basis points to 8 percent to make funds costlier, the eighth straight increase in less than two years.

The latest move comes as Bangladesh's annual average inflation crept up to 9.59 percent last month, way above the central bank's revised target of 7.5 percent for the financial year ending in June.

In the meeting, the central bank presented all the measures that have been taken to restore normalcy in the economy and expressed their hopes that the economy would rebound after June.

The current level of reserves can cover four months' import payments and this level will be maintained in the upcoming months, the BB told the WB.

The ongoing reform programmes related to the exchange rate and the monetary policy will continue, it said.

The central bank has unveiled a roadmap for the reform of the banking sector.

Speaking to the media after the meeting between the WB and the finance ministry, Finance Secretary Md Khairuzzaman Mozumder said the macroeconomic situation and the reform programme were discussed.

"The World Bank said that Bangladesh's policy is on the right track. They also highlighted the challenge stemming from higher inflation."

The ministry informed the visiting team about the steps that the government has taken.

Inflation surged initially because of the lingering impacts of the coronavirus pandemic and fresh disruptions caused by the Russia-Ukraine war. Later, it was fueled by the depreciation of the local currency and market mismanagement.

To stem foreign exchange reserve losses and help restore external balance, the central bank allowed the taka to weaken by close to 20 percent in 2022-23. The pass-through of a sharp depreciation of the local currency accounted for half of the inflation surge seen in Bangladesh in the last financial year, said the IMF in December.

Thanks to the government's measures, inflation will come down to 7.5 percent by June, Mozumder told the WB team.

The WB is Bangladesh's largest development partner.

Since Bangladesh's independence, it has committed about $41 billion in financing in the form of grants, interest-free loans, and concessional credits. Currently, Bangladesh has the largest ongoing IDA programme in the world.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments